Page 331 - Tata_Chemicals_yearly-reports-2021-22

P. 331

01 INTEGRATED 73 STATUTORY 178 FINANCIAL

STATEMENTS

REPORT

REPORTS

Consolidated

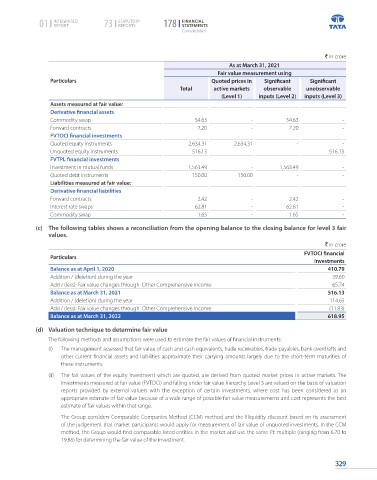

` in crore

As at March 31, 2021

Fair value measurement using

Particulars Quoted prices in Significant Significant

Total active markets observable unobservable

(Level 1) inputs (Level 2) inputs (Level 3)

Assets measured at fair value:

Derivative financial assets

Commodity swap 54.63 - 54.63 -

Forward contracts 7.20 - 7.20 -

FVTOCI financial investments

Quoted equity instruments 2,634.31 2,634.31 - -

Unquoted equity instruments 516.13 - - 516.13

FVTPL financial investments

Investment in mutual funds 1,563.49 - 1,563.49 -

Quoted debt instruments 150.00 150.00 - -

Liabilities measured at fair value:

Derivative financial liabilities

Forward contracts 2.42 - 2.42 -

Interest rate swaps 62.81 - 62.81 -

Commodity swap 1.65 - 1.65 -

(c) The following tables shows a reconciliation from the opening balance to the closing balance for level 3 fair

values.

` in crore

FVTOCI financial

Particulars

investments

Balance as at April 1, 2020 410.79

Addition / (deletion) during the year 39.60

Add / (less): Fair value changes through Other Comprehensive Income 65.74

Balance as at March 31, 2021 516.13

Addition / (deletion) during the year 114.65

Add / (less): Fair value changes through Other Comprehensive Income (11.83)

Balance as at March 31, 2022 618.95

(d) Valuation technique to determine fair value

The following methods and assumptions were used to estimate the fair values of financial instruments:

(i) The management assessed that fair value of cash and cash equivalents, trade receivables, trade payables, bank overdrafts and

other current financial assets and liabilities approximate their carrying amounts largely due to the short-term maturities of

these instruments.

(ii) The fair values of the equity investment which are quoted, are derived from quoted market prices in active markets. The

Investments measured at fair value (FVTOCI) and falling under fair value hierarchy Level 3 are valued on the basis of valuation

reports provided by external valuers with the exception of certain investments, where cost has been considered as an

appropriate estimate of fair value because of a wide range of possible fair value measurements and cost represents the best

estimate of fair values within that range.

The Group considers Comparable Companies Method (CCM) method and the illiquidity discount based on its assessment

of the judgement that market participants would apply for measurement of fair value of unquoted investments. In the CCM

method, the Group would find comparable listed entities in the market and use the same PE multiple (ranging from 6.70 to

19.88) for determining the fair value of the investment.

329