Page 332 - Tata_Chemicals_yearly-reports-2021-22

P. 332

Integrated Annual Report 2021-22

(iii) The fair values of investments in mutual fund units is based on the net asset value (‘NAV’) as stated by the issuers of these

mutual fund units in the published statements as at Balance Sheet date. NAV represents the price at which the issuer will issue

further units of mutual fund and the price at which issuers will redeem such units from the investors.

(iv) The Group enters into derivative financial instruments with various counterparties, principally financial institutions with

investment grade credit ratings. The fair value of derivative financial instruments is based on observable market inputs including

currency spot and forward rate, yield curves, currency volatility, credit quality of counterparties, interest rate curves and forward

rate curves of the underlying commodity etc. and use of appropriate valuation models.

(v) The fair value of non-current borrowings carrying floating-rate of interest is not impacted due to interest rate changes, and will

not be significantly different from their carrying amounts as there is no significant change in the underlying credit risk of the

Group (since the date of inception of the loans).

(e) Financial risk management objectives

The Group is exposed to market risk (including currency risk, interest rate risk and other price risk), credit risk and liquidity risk. The

Group’s risk management strategies focus on the un-predictability of these elements and seek to minimise the potential adverse

effects on its financial performance. The Board of Directors/Committee of Board of the respective operating entities approve the risk

management policies. The implementation of these policies is the responsibility of the operating entities. The Board of Directors/

Committee of Board of the respective operating entities periodically review the exposures to financial risks, and the measures taken

for risk mitigation and the results thereof.

All hedging activities for risk management purposes are carried out by specialist teams that have the appropriate skills, experience

and supervision. The Group’s policy is not to trade in derivatives for speculative purposes.

Market risk

Market risk is the risk that the fair value of future cash flows of a financial instrument will fluctuate because of changes in market

prices. Market risk comprises three types of risk: currency risk, interest rate risk and other price risk, such as equity price risk and

commodity price risk. The value of a financial instrument may change as a result of changes in the interest rates, foreign currency

exchange rates, equity price fluctuations, commodity price, liquidity and other market changes. Financial instruments affected by

market risk include borrowings, deposits, investments, forex receivables, forex payables and derivative financial instruments.

Foreign currency risk management

Foreign exchange risk arises on future commercial transactions and all recognised monetary assets and liabilities which are

denominated in a currency other than the functional currency of the entities of the Group. The foreign exchange risk management

policy requires operating entities to manage their foreign exchange risk against their functional currency and to meet this objective

they enter into derivatives such as foreign currency forwards, option and swap contracts, as considered appropriate and whenever

necessary.

The Group has international operations and hence, it is exposed to foreign exchange risk arising from various currencies, primarily

with respect to USD. As at the end of the reporting period, the carrying amounts of the Group’s foreign currency denominated

monetary assets and liabilities, in respect to the primary foreign currency exposure i.e. USD, and derivative to hedge the foreign

currency exposure are as follows:

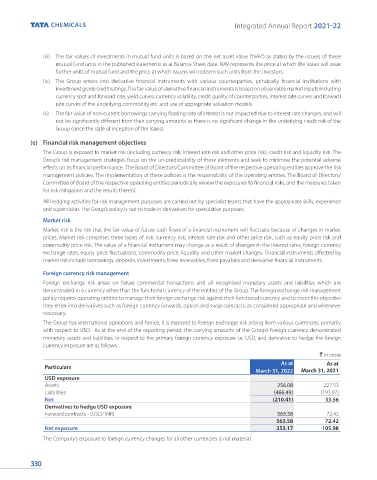

` in crore

As at As at

Particulars

March 31, 2022 March 31, 2021

USD exposure

Assets 256.08 227.53

Liabilities (466.49) (193.97)

Net (210.41) 33.56

Derivatives to hedge USD exposure

Forward contracts - (USD/ INR) 563.58 72.42

563.58 72.42

Net exposure 353.17 105.98

The Company’s exposure to foreign currency changes for all other currencies is not material.

330