Page 328 - Tata_Chemicals_yearly-reports-2021-22

P. 328

Integrated Annual Report 2021-22

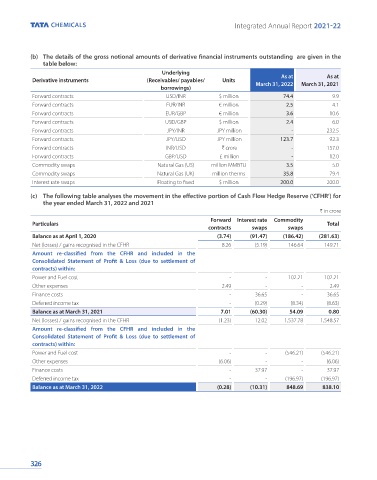

(b) The details of the gross notional amounts of derivative financial instruments outstanding are given in the

table below:

Underlying

As at

As at

Derivative instruments (Receivables/ payables/ Units March 31, 2022 March 31, 2021

borrowings)

Forward contracts USD/INR $ million 74.4 9.9

Forward contracts EUR/INR € million 2.5 4.1

Forward contracts EUR/GBP € million 3.6 10.6

Forward contracts USD/GBP $ million 2.4 6.0

Forward contracts JPY/INR JPY million - 232.5

Forward contracts JPY/USD JPY million 123.7 92.3

Forward contracts INR/USD ₹ crore - 157.0

Forward contracts GBP/USD £ million - 12.0

Commodity swaps Natural Gas (US) million MMBTU 3.5 5.0

Commodity swaps Natural Gas (UK) million therms 35.8 79.4

Interest rate swaps Floating to fixed $ million 200.0 200.0

(c) The following table analyses the movement in the effective portion of Cash Flow Hedge Reserve (‘CFHR’) for

the year ended March 31, 2022 and 2021

₹ in crore

Forward Interest rate Commodity

Particulars Total

contracts swaps swaps

Balance as at April 1, 2020 (3.74) (91.47) (186.42) (281.63)

Net (losses) / gains recognised in the CFHR 8.26 (5.19) 146.64 149.71

Amount re-classified from the CFHR and included in the

Consolidated Statement of Profit & Loss (due to settlement of

contracts) within:

Power and Fuel cost - - 102.21 102.21

Other expenses 2.49 - - 2.49

Finance costs - 36.65 - 36.65

Deferred income tax - (0.29) (8.34) (8.63)

Balance as at March 31, 2021 7.01 (60.30) 54.09 0.80

Net (losses) / gains recognised in the CFHR (1.23) 12.02 1,537.78 1,548.57

Amount re-classified from the CFHR and included in the

Consolidated Statement of Profit & Loss (due to settlement of

contracts) within:

Power and Fuel cost - - (546.21) (546.21)

Other expenses (6.06) - - (6.06)

Finance costs - 37.97 - 37.97

Deferred income tax - - (196.97) (196.97)

Balance as at March 31, 2022 (0.28) (10.31) 848.69 838.10

326