Page 175 - Tata_Chemicals_yearly-reports-2017-18

P. 175

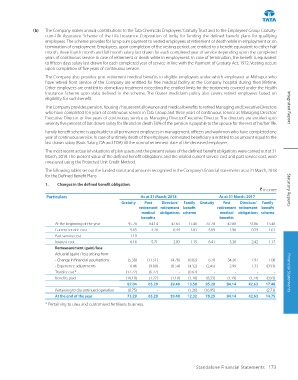

(b) The Company makes annual contributions to the Tata Chemicals Employees’ Gratuity Trust and to the Employees’ Group Gratuity-

cum-Life Assurance Scheme of the Life Insurance Corporation of India, for funding the defined benefit plans for qualifying

employees. The scheme provides for lump sum payment to vested employees at retirement or death while in employment or on

termination of employment. Employees, upon completion of the vesting period, are entitled to a benefit equivalent to either half

month, three fourth month and full month salary last drawn for each completed year of service depending upon the completed

years of continuous service in case of retirement or death while in employment. In case of termination, the benefit is equivalent

to fifteen days salary last drawn for each completed year of service in line with the Payment of Gratuity Act, 1972. Vesting occurs

upon completion of five years of continuous service.

The Company also provides post retirement medical benefits to eligible employees under which employees at Mithapur who

have retired from service of the Company are entitled for free medical facility at the Company hospital during their lifetime.

Other employees are entitled to domiciliary treatment exceeding the entitled limits for the treatments covered under the Health

Insurance Scheme upto slabs defined in the scheme. The floater mediclaim policy also covers retired employees based on

eligibility, for such benefit.

The Company provides pension, housing / house rent allowance and medical benefits to retired Managing and Executive Directors Integrated Report

who have completed ten years of continuous service in Tata Group and three years of continuous service as Managing Director/

Executive Director or five years of continuous service as Managing Director/Executive Director. The directors are entitled upto

seventy five percent of last drawn salary for life and on death 50% of the pension is payable to the spouse for the rest of his/her life.

Family benefit scheme is applicable to all permanent employees in management, officers and workmen who have completed one

year of continuous service. In case of untimely death of the employee, nominated beneficiary is entitled to an amount equal to the

last drawn salary (Basic Salary, DA and FDA) till the normal retirement date of the deceased employee.

The most recent actuarial valuations of plan assets and the present values of the defined benefit obligations were carried out at 31

March, 2018. The present value of the defined benefit obligations and the related current service cost and past service cost, were

measured using the Projected Unit Credit Method.

The following tables set out the funded status and amounts recognised in the Company’s financial statements as at 31 March, 2018

for the Defined Benefit Plans.

1. Changes in the defined benefit obligation:

` in crore Statutory Reports

Particulars As at 31 March, 2018 As at 31 March, 2017

Gratuity Post Directors’ Family Gratuity Post Directors’ Family

retirement retirement benefit retirement retirement benefit

medical obligations scheme medical obligations scheme

benefits benefits

At the beginning of the year 95.20 84.14 42.63 17.48 87.78 42.88 31.86 15.48

Current service cost 5.65 4.20 0.44 1.81 5.09 1.90 0.29 1.61

Past service cost 1.19 - - - - - - -

Interest cost 6.16 5.71 2.83 1.15 6.41 3.30 2.42 1.17

Remeasurement (gain)/loss

Actuarial (gain) / loss arising from:

- Change in financial assumptions (5.30) (11.51) (4.78) (0.82) 6.70 34.26 7.97 1.08

- Experience adjustments 6.46 (9.80) (0.54) (4.32) (2.45) 2.99 1.33 (0.93)

Transfer out * (17.22) (6.27) - (0.62) - - - - Financial Statements

Benefits paid (10.10) (1.27) (1.18) (1.10) (8.33) (1.19) (1.24) (0.93)

82.04 65.20 39.40 13.58 95.20 84.14 42.63 17.48

Pertaining to discontinued operation (8.75) - - (1.26) (16.95) - - (2.73)

At the end of the year 73.29 65.20 39.40 12.32 78.25 84.14 42.63 14.75

* Pertaining to urea and customised fertilisers business.

Standalone Financial Statements 173