Page 172 - Tata_Chemicals_yearly-reports-2017-18

P. 172

31. Discontinued operations

(I) Disposal of urea and customised fertilisers business

During the previous year, the Company entered into an agreement with Yara Fertilisers India Private Limited (‘Yara India’) to transfer its

Urea Business (which comprises of manufacturing facilities for urea and customised fertilisers at Babrala, Uttar Pradesh), by way of a

slump sale.

On 12 January, 2018, the Company consummated the sale and transfer of its Urea and Customised Fertilisers Business to

Yara India as contemplated in the Scheme of Arrangement dated 10 August, 2016. The pre-tax gain of ` 1,279.39 crore for the year ended

31 March, 2018 is included under exceptional gain for discontinued operations.

(II) Disposal of Phosphatic Fertilisers business and Trading business of bulk and non-bulk fertilisers

The Company has entered into an agreement with IRC Agrochemicals Private Limited (“IRC”) and Indorama Holdings BV,

Netherlands (Parent company of IRC) to transfer its Phosphatic Fertilisers business and Trading business (which comprises of

manufacturing facilities for phosphatic fertilisers at Haldia Plant), by way of a slump sale for a consideration of ` 375.00 crore (subject

to certain adjustments). The effect of the transfer will be reflected in the financial information of the period in which the deal is

consummated post receipt of all the requisite regulatory approvals.

The financial performance and cash flows for Urea Business (till the date of sale) and Phosphatic Fertilisers business and Trading

business of bulk and non-bulk fertilisers:

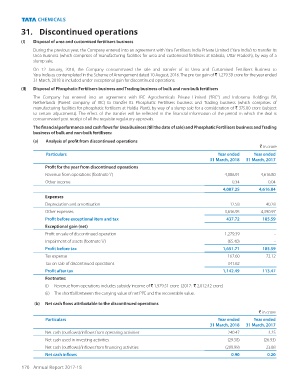

(a) Analysis of profit from discontinued operations

` in crore

Particulars Year ended Year ended

31 March, 2018 31 March, 2017

Profit for the year from discontinued operations

Revenue from operations (footnote ‘i’) 4,086.91 4,616.80

Other income 0.34 0.04

4,087.25 4,616.84

Expenses

Depreciation and amortisation 12.58 40.28

Other expenses 3,636.95 4,390.97

Profit before exceptional item and tax 437.72 185.59

Exceptional gain (net)

Profit on sale of discontinued operation 1,279.39 -

Impairment of assets (footnote ‘ii’) (65.40) -

Profit before tax 1,651.71 185.59

Tax expense 167.60 72.12

Tax on sale of discontinued operations 341.62

Profit after tax 1,142.49 113.47

Footnotes:

(i) Revenue from operations includes subsidy income of ` 1,979.51 crore (2017: ` 2,012.42 crore)

(ii) The shortfall between the carrying value of net PPE and the recoverable value.

(b) Net cash flows attributable to the discontinued operations

` in crore

Particulars Year ended Year ended

31 March, 2018 31 March, 2017

Net cash (outflows)/inflows from operating activities 240.47 3.25

Net cash used in investing activities (29.58) (26.93)

Net cash (outflows)/inflows from financing activities (209.99) 23.88

Net cash inflows 0.90 0.20

170 Annual Report 2017-18