Page 174 - Tata_Chemicals_yearly-reports-2017-18

P. 174

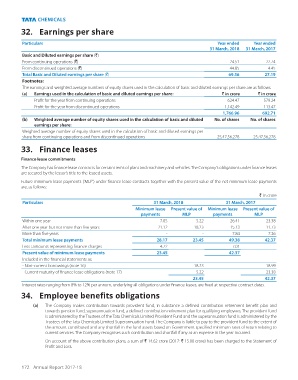

32. Earnings per share

Particulars Year ended Year ended

31 March, 2018 31 March, 2017

Basic and Diluted earnings per share (`)

From continuing operations (`) 24.51 22.74

From discontinued operations (`) 44.85 4.45

Total Basic and Diluted earnings per share (`) 69.36 27.19

Footnotes:

The earnings and weighted average numbers of equity shares used in the calculation of basic and diluted earnings per share are as follows.

(a) Earnings used in the calculation of basic and diluted earnings per share: ` in crore ` in crore

Profit for the year from continuing operations 624.47 579.24

Profit for the year from discontinued operations 1,142.49 113.47

1,766.96 692.71

(b) Weighted average number of equity shares used in the calculation of basic and diluted No. of shares No. of shares

earnings per share:

Weighted average number of equity shares used in the calculation of basic and diluted earnings per

share from continuing operations and from discontinued operations 25,47,56,278 25,47,56,278

33. Finance leases

Finance lease commitments

The Company has finance lease contracts for certain items of plant and machinery and vehicles. The Company’s obligations under finance leases

are secured by the lessor’s title to the leased assets.

Future minimum lease payments (‘MLP’) under finance lease contracts together with the present value of the net minimum lease payments

are, as follows:

` in crore

Particulars 31 March, 2018 31 March, 2017

Minimum lease Present value of Minimum lease Present value of

payments MLP payments MLP

Within one year 7.05 5.22 26.41 23.38

After one year but not more than five years 21.12 18.23 15.13 11.73

More than five years - - 7.84 7.26

Total minimum lease payments 28.17 23.45 49.38 42.37

Less : amounts representing finance charges 4.72 7.01

Present value of minimum lease payments 23.45 42.37

Included in the financial statements as:

- Non-current borrowings (note 16) 18.23 18.99

- Current maturity of finance lease obligations (note 17) 5.22 23.38

23.45 42.37

Interest rates ranging from 8% to 12% per annum, underlying all obligations under finance leases, are fixed at respective contract dates.

(PSOR\HH EHQHȴWV REOLJDWLRQV

(a) The Company makes contribution towards provident fund, in substance a defined contribution retirement benefit plan and

towards pension fund, superannuation fund, a defined contribution retirement plan for qualifying employees. The provident fund

is administered by the Trustees of the Tata Chemicals Limited Provident Fund and the superannuation fund is administered by the

Trustees of the Tata Chemicals Limited Superannuation Fund. The Company is liable to pay to the provident fund to the extent of

the amount contributed and any shortfall in the fund assets based on Government specified minimum rates of return relating to

current services. The Company recognises such contribution and shortfall if any as an expense in the year incurred.

On account of the above contribution plans, a sum of ` 14.62 crore (2017: ` 15.00 crore) has been charged to the Statement of

Profit and Loss.

172 Annual Report 2017-18