Page 178 - Tata_Chemicals_yearly-reports-2017-18

P. 178

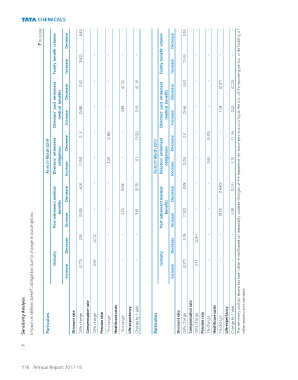

` in crore Decrease 0.43 - - - - Decrease 0.53 - - - -

Family benefit scheme Increase (0.42) - - - - Family benefit scheme Increase (0.49) - - - -

Directors’ post retirement medical benefits Decrease Increase 0.42 (0.38) - - - - (0.72) 0.88 (0.19) 0.19 Directors’ post retirement medical benefits Decrease Increase 0.52 (0.46) - - - - (0.87) 1.08 (0.23) 0.22

2.15 - (2.86) - (1.02) Decrease 2.51 - (3.30) - (1.16)

Decrease

As at 31 March 2018 Directors’ retirement obligations Increase (1.94) - 3.29 - 1.01 As at 31 March 2017 Directors’ retirement obligations Increase (2.25) - 3.83 - 1.15 The sensitivity analysis above has been determined based on reasonably possible changes of the respective key assumptions occurring at the end of the reporting period, while holding all

Post retirement medical benefits Decrease Increase 6.05 (5.33) - - - - (9.93) 12.53 (3.78) 3.81 Post retirement medical benefits Decrease Increase 8.98 (7.82) - - - - (14.40) 18.50 (5.01) 5.09

Impact on defined benefit obligation due to change in assumptions

2.85 (2.72) - - - 3.18 (2.94) - - -

Decrease Decrease

Gratuity (2.70) 2.90 - - - Gratuity (2.97) 3.11 - - -

Increase Increase

Sensitivity Analysis Particulars Discount rate 0.5% change Compensation rate 0.5% change Pension rate 1% change Healthcare costs 1% change Life expectancy Change by 1 year Particulars Discount rate 0.5% change Compensation rate 0.5% change Pension rate 1% change Healthcare costs 1% change Life expectancy Change by 1 year other assumptions constant.

7

176 Annual Report 2017-18