Page 171 - Tata_Chemicals_yearly-reports-2017-18

P. 171

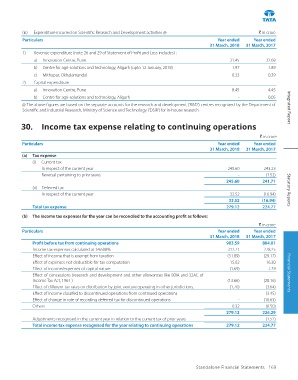

(iii) Expenditure incurred on Scientific Research and Development activities @ ` in crore

Particulars Year ended Year ended

31 March, 2018 31 March, 2017

1) Revenue expenditure (note 26 and 29 of Statement of Profit and Loss includes) :

a) Innovation Centre, Pune 31.45 32.68

b) Centre for agri-solutions and technology, Aligarh (upto 12 January, 2018) 1.97 1.89

c) Mithapur, Okhalamandal 0.33 0.39

2) Capital expenditure

a) Innovation Centre, Pune 8.45 4.45

b) Centre for agri-solutions and technology, Aligarh - 0.05

@ The above figures are based on the separate accounts for the research and development (‘R&D’) centres recognised by the Department of

Scientific and Industrial Research, Ministry of Science and Technology (‘DSIR’) for in-house research. Integrated Report

30. Income tax expense relating to continuing operations

` in crore

Particulars Year ended Year ended

31 March, 2018 31 March, 2017

(a) Tax expense

(i) Current tax

In respect of the current year 245.60 243.23

Reversal pertaining to prior years - (1.52)

245.60 241.71

(ii) Deferred tax Statutory Reports

In respect of the current year 33.52 (16.94)

33.52 (16.94)

Total tax expense 279.12 224.77

(b) The income tax expenses for the year can be reconciled to the accounting profit as follows:

` in crore

Particulars Year ended Year ended

31 March, 2018 31 March, 2017

Profit before tax from continuing operations 903.59 804.01

Income tax expenses calculated at 34.608% 312.71 278.25

Effect of income that is exempt from taxation (31.89) (29.17)

Effect of expenses not deductible for tax computation 15.02 16.30

Effect of income/expenses of capital nature (1.69) 7.29

Effect of concessions (research and development and other allowances like 80IA and 32AC of Financial Statements

Income Tax Act, 1961 ) (13.66) (28.16)

Effect of different tax rates on distribution by joint venture operating in other jurisdictions. (1.70) (3.64)

Effect of income classifed to discontinued operations from continued operations - (3.45)

Effect of change in rate of recording deferred tax for discontinued operations - (10.63)

Others 0.32 (0.50)

279.12 226.29

Adjustments recognised in the current year in relation to the current tax of prior years - (1.52)

Total income tax expense recognised for the year relating to continuing operations 279.12 224.77

Standalone Financial Statements 169