Page 348 - Tata Chemical Annual Report_2022-2023

P. 348

Integrated Annual Report 2022-23 01-83 84-192 193-365

Integrated Report Statutory Reports Financial Statements

Consolidated

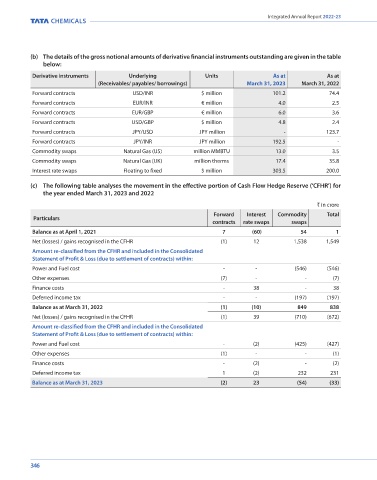

(b) The details of the gross notional amounts of derivative financial instruments outstanding are given in the table 43. Disclosures on financial instruments

below: (a) Financial instruments by category

Derivative instruments Underlying Units As at As at The following table presents the carrying amounts of each category of financial assets and liabilities as at March 31, 2023

(Receivables/ payables/ borrowings) March 31, 2023 March 31, 2022

Forward contracts USD/INR $ million 101.2 74.4 ` in crore

Forward contracts EUR/INR € million 4.0 2.5 Investments - Investments - Derivatives - Derivatives - Amortised Total carrying

Particulars

Forward contracts EUR/GBP € million 6.0 3.6 FVTOCI FVTPL FVTPL FVTOCI cost value

Forward contracts USD/GBP $ million 4.8 2.4 Financial assets

Forward contracts JPY/USD JPY million - 123.7 (a) Investments - non current

Forward contracts JPY/INR JPY million 192.5 - Equity instrument at fair value 4,892 - - - - 4,892

Commodity swaps Natural Gas (US) million MMBTU 13.0 3.5 Debt instrument at fair value - 150 - - - 150

Commodity swaps Natural Gas (UK) million therms 17.4 35.8 (b) Investments - current

Interest rate swaps Floating to fixed $ million 303.5 200.0 Investment in mutual funds - 1,231 - - - 1,231

Investment in Non convertible - 39 - - - 39

(c) The following table analyses the movement in the effective portion of Cash Flow Hedge Reserve (‘CFHR’) for Debentures - quoted

the year ended March 31, 2023 and 2022 (c) Trade receivables - - - - 2,627 2,627

` in crore (d) Cash and cash equivalents - - - - 508 508

Forward Interest Commodity Total (e) Other bank balances - - - - 157 157

Particulars

contracts rate swaps swaps (f) Loans - current - - - - 325 325

Balance as at April 1, 2021 7 (60) 54 1 (g) Other financial assets - non- - - - 8 32 40

Net (losses) / gains recognised in the CFHR (1) 12 1,538 1,549 current

Amount re-classified from the CFHR and included in the Consolidated (h) Other financial assets - current - - - 22 39 61

Statement of Profit & Loss (due to settlement of contracts) within: Total 4,892 1,420 - 30 3,688 10,030

Power and Fuel cost - - (546) (546) Financial liabilities

Other expenses (7) - - (7) (a) Borrowings - non-current - - 5,540 5,540

Finance costs - 38 - 38 (b) Lease liabilities - non-current - - 137 137

Deferred income tax - - (197) (197) (c) Borrowings - current - - 543 543

Balance as at March 31, 2022 (1) (10) 849 838 (d) Lease liabilities - current - - 76 76

Net (losses) / gains recognised in the CFHR (1) 39 (710) (672) (e) Trade payables - - 2,597 2,597

Amount re-classified from the CFHR and included in the Consolidated (f) Other financial liabilities - - 23 25 48

Statement of Profit & Loss (due to settlement of contracts) within: non-current

Power and Fuel cost - (2) (425) (427) (g) Other financial liabilities - 7 125 564 696

Other expenses (1) - - (1) current

Finance costs - (2) - (2) Total 7 148 9,482 9,637

Deferred income tax 1 (2) 232 231

Balance as at March 31, 2023 (2) 23 (54) (33)

346 347