Page 244 - Tata_Chemicals_yearly-reports-2017-18

P. 244

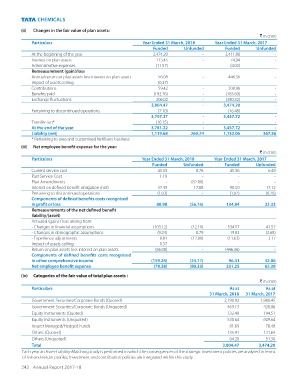

(ii) Changes in the fair value of plan assets:

` in crore

Particulars Year Ended 31 March, 2018 Year Ended 31 March, 2017

Funded Unfunded Funded Unfunded

At the beginning of the year 3,474.20 - 3,411.88 -

Interest on plan assets 113.45 - 74.94 -

Administrative expenses (11.57) - (4.02) -

Remeasurement (gain)/loss

Annual return on plan assets less interest on plan assets 56.08 - 446.36 -

Impact of assets ceiling (0.37) - - -

Contributions 59.42 - 108.96 -

Benefits paid (192.76) - (183.60) -

Exchange fluctuations 306.02 - (380.32) -

3,804.47 - 3,474.20 -

Pertaining to discontinued operations (7.10) - (16.48) -

3,797.37 - 3,457.72 -

Transfer out* (16.15) - - -

At the end of the year 3,781.22 - 3,457.72 -

Liability (net) 1,119.68 269.24 1,152.06 367.56

* Pertaining to urea and customised fertilisers business

(iii) Net employee benefit expense for the year:

` in crore

Particulars Year Ended 31 March, 2018 Year Ended 31 March, 2017

Funded Unfunded Funded Unfunded

Current service cost 43.33 8.76 45.36 6.49

Past Service Cost 1.19 - - -

Plan Amendments - (82.80) - -

Interest on defined benefit obligation (net) 37.49 17.88 90.50 17.12

Pertaining to discontinued operations (1.03) - (1.02) (0.28)

Components of defined benefits costs recognised

in profit or loss 80.98 (56.16) 134.84 23.33

Remeasurements of the net defined benefit

liability/(asset)

Actuarial (gain) / loss arising from:

- Changes in financial assumptions (103.12) (12.16) 534.57 41.57

- Changes in demographic assumptions (9.24) 0.79 19.83 (2.68)

- Experience adjustments 8.81 (12.80) (11.63) 3.17

Impact of assets ceiling 0.37 - - -

Return on plan assets less interest on plan assets (56.08) - (446.36) -

Components of defined benefits costs recognised

in other comprehensive income (159.26) (24.17) 96.41 42.06

Net employee benefit expense (78.28) (80.33) 231.25 65.39

(iv) Categories of the fair value of total plan assets :

` in crore

Particulars As at As at

31 March, 2018 31 March, 2017

Government Securities/Corporate Bonds (Quoted) 2,190.92 1,980.45

Government Securities/Corporate Bonds (Unquoted) 469.13 428.06

Equity Instruments (Quoted) 332.48 194.51

Equity Instruments (Unquoted) 530.64 609.64

Insurer Managed/Hedged Funds 81.69 78.48

Others (Quoted) 135.41 131.69

Others (Unquoted) 64.20 51.36

Total 3,804.47 3,474.20

Each year an Asset-Liability-Matching study is performed in which the consequences of the strategic investment policies are analysed in terms

of risk-and-return profiles. Investment and contribution policies are integrated within this study.

242 Annual Report 2017-18