Page 243 - Tata_Chemicals_yearly-reports-2017-18

P. 243

TCNA’s contribution to these plans was ` 4.04 crore (2017: ` 3.90 crore) for the year ended 31 March, 2018 and 31 March, 2017

respectively.

Pension plans and other post retirement benefit

TCNA maintains several defined benefit pension plans covering substantially all employees. A participating employee’s annual post

retirement pension benefit is determined by the employee’s credited service and, in most plans, final average annual earnings with

the TCNA. Vesting requirements are two years. TCNA’s funding policy is to annually contribute the statutorily required minimum

amount as actuarially determined. TCNA also maintains several plans providing non-pension post retirement benefits covering

substantially all hourly and certain salaried employees. TCNA funds these benefits on a pay-as-you-go basis.

Plan assets

The assets of TCNA’s defined benefit plans are managed on a commingled basis in a Master Trust. The investment policy and

allocation of the assets in the Master Trust were approved by TCNA’s Investment Committee, which has oversight responsibility for

the retirement plans.

The pension fund assets are invested in accordance with the statement of Investment Policies and Procedures adopted by TCNA, Integrated Report

which are reviewed annually. Pension fund assets are invested on a going-concern basis with the primary objective of providing

reasonable rates of return consistent with available market opportunities, a quality standard of investment, and moderate levels of

risk.

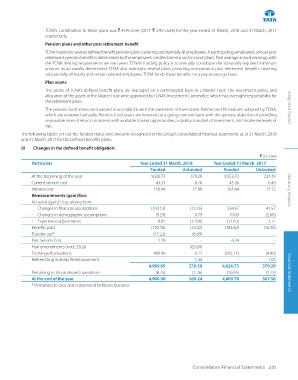

The following tables set out the funded status and amounts recognised in the Group’s consolidated financial statements as at 31 March, 2018

and 31 March, 2017 for the Defined benefits plans:

(i) Changes in the defined benefit obligation:

` in crore

Particulars Year Ended 31 March, 2018 Year Ended 31 March, 2017

Funded Unfunded Funded Unfunded

At the beginning of the year 4,626.73 370.29 4,553.73 324.49

Current service cost 43.33 8.76 45.36 6.49

Interest cost 150.94 17.88 165.44 17.12 Statutory Reports

Remeasurements (gain)/loss

Actuarial (gain) / loss arising from:

- Changes in financial assumptions (103.12) (12.16) 534.57 41.57

- Changes in demographic assumptions (9.24) 0.79 19.83 (2.68)

- Experience adjustments 8.81 (12.80) (11.63) 3.17

Benefits paid (192.76) (14.22) (183.60) (16.50)

Transfer out* (17.22) (6.89) - -

Past Service Cost 1.19 - 6.24 -

Plan amendments (note 32(a)) - (82.80) - -

Exchange fluctuations 400.99 0.22 (503.21) (4.40)

Retiree Drug Subsidy Reimbursement - 1.44 - 1.03

4,909.65 270.50 4,626.73 370.29

Pertaining to discontinued operations (8.75) (1.26) (16.95) (2.73) Financial Statements

At the end of the year 4,900.90 269.24 4,609.78 367.56

* Pertaining to urea and customised fertilisers business

Consolidated Financial Statements 241