Page 166 - Tata_Chemicals_yearly-reports-2017-18

P. 166

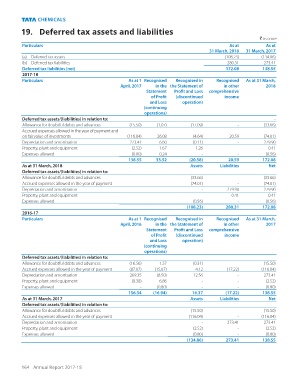

19. Deferred tax assets and liabilities

` in crore

Particulars As at As at

31 March, 2018 31 March, 2017

(a) Deferred tax assets (108.23) (134.86)

(b) Deferred tax liabilities 280.31 273.41

Deferred tax liabilities (net) 172.08 138.55

2017-18

Particulars As at 1 Recognised Recognised in Recognised As at 31 March,

April, 2017 in the the Statement of in other 2018

Statement Profit and Loss comprehensive

of Profit (discontinued income

and Loss operation)

(continuing

operations)

Deferred tax assets/(liabilities) in relation to: -

Allowance for doubtful debts and advances (15.50) (1.07) (17.09) - (33.66)

Accrued expenses allowed in the year of payment and

on fairvalue of investments (116.04) 26.08 (4.64) 20.59 (74.01)

Depreciation and amortisation 273.41 6.60 (0.11) - 279.90

Property, plant and equipment (2.52) 1.67 1.26 - 0.41

Expenses allowed (0.80) 0.24 - - (0.56)

138.55 33.52 (20.58) 20.59 172.08

As at 31 March, 2018 Assets Liabilities Net

Deferred tax assets/(liabilities) in relation to:

Allowance for doubtful debts and advances (33.66) - (33.66)

Accrued expenses allowed in the year of payment (74.01) - (74.01)

Depreciation and amortisation - 279.90 279.90

Property, plant and equipment - 0.41 0.41

Expenses allowed (0.56) - (0.56)

(108.23) 280.31 172.08

2016-17

Particulars As at 1 Recognised Recognised in Recognised As at 31 March,

April, 2016 in the the Statement of in other 2017

Statement Profit and Loss comprehensive

of Profit (discontinued income

and Loss operation)

(continuing

operations)

Deferred tax assets/(liabilities) in relation to:

Allowance for doubtful debts and advances (16.56) 1.37 (0.31) - (15.50)

Accrued expenses allowed in the year of payment (87.07) (15.87) 4.12 (17.22) (116.04)

Depreciation and amortisation 269.35 (8.50) 12.56 - 273.41

Property, plant and equipment (9.38) 6.86 - - (2.52)

Expenses allowed - (0.80) - - (0.80)

156.34 (16.94) 16.37 (17.22) 138.55

As at 31 March, 2017 Assets Liabilities Net

Deferred tax assets/(liabilities) in relation to:

Allowance for doubtful debts and advances (15.50) - (15.50)

Accrued expenses allowed in the year of payment (116.04) - (116.04)

Depreciation and amortisation - 273.41 273.41

Property, plant and equipment (2.52) - (2.52)

Expenses allowed (0.80) - (0.80)

(134.86) 273.41 138.55

164 Annual Report 2017-18