Page 161 - Tata_Chemicals_yearly-reports-2017-18

P. 161

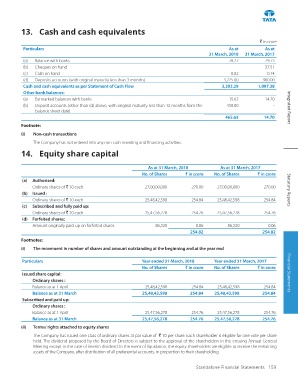

13. Cash and cash equivalents

` in crore

Particulars As at As at

31 March, 2018 31 March, 2017

(a) Balance with banks 78.27 79.73

(b) Cheques on hand - 37.51

(c) Cash on hand 0.02 0.14

(d) Deposits accounts (with original maturity less than 3 months) 3,225.00 980.00

Cash and cash equivalents as per Statement of Cash Flow 3,303.29 1,097.38

Other bank balances:

(a) Earmarked balances with banks 15.63 14.70

(b) Deposit accounts (other than (d) above, with original maturity less than 12 months from the 450.00 - Integrated Report

balance sheet date)

465.63 14.70

Footnote:

(i) Non-cash transactions

The Company has not entered into any non cash investing and financing activities.

(TXLW\ VKDUH FDSLWDO

As at 31 March, 2018 As at 31 March, 2017

No. of Shares ` in crore No. of Shares ` in crore

(a) Authorised:

Ordinary shares of ` 10 each 27,00,00,000 270.00 27,00,00,000 270.00 Statutory Reports

(b) Issued :

Ordinary shares of ` 10 each 25,48,42,598 254.84 25,48,42,598 254.84

(c) Subscribed and fully paid up:

Ordinary shares of ` 10 each 25,47,56,278 254.76 25,47,56,278 254.76

(d) Forfeited shares:

Amount originally paid-up on forfeited shares 86,320 0.06 86,320 0.06

254.82 254.82

Footnotes:

(i) The movement in number of shares and amount outstanding at the beginning and at the year end

Particulars Year ended 31 March, 2018 Year ended 31 March, 2017

No. of Shares ` in crore No. of Shares ` in crore

Issued share capital: Financial Statements

Ordinary shares :

Balance as at 1 April 25,48,42,598 254.84 25,48,42,598 254.84

Balance as at 31 March 25,48,42,598 254.84 25,48,42,598 254.84

Subscribed and paid up:

Ordinary shares :

Balance as at 1 April 25,47,56,278 254.76 25,47,56,278 254.76

Balance as at 31 March 25,47,56,278 254.76 25,47,56,278 254.76

(ii) Terms/ rights attached to equity shares

The Company has issued one class of ordinary shares at par value of ` 10 per share. Each shareholder is eligible for one vote per share

held. The dividend proposed by the Board of Directors is subject to the approval of the shareholders in the ensuing Annual General

Meeting except in the case of interim dividend. In the event of liquidation, the equity shareholders are eligible to receive the remaining

assets of the Company, after distribution of all preferential accounts, in proportion to their shareholding.

Standalone Financial Statements 159