Page 164 - Tata_Chemicals_yearly-reports-2017-18

P. 164

Footnotes:

(i) Loans from banks on Cash Credit carry an interest ranging from 8.30% p.a. to 9.00% p.a. and are secured by way of hypothecation of stocks

of raw materials, finished products, stores and work-in-process as well as book debts.

(ii) During the previous year ended 31 March, 2017, Supplier’s credit due for payment within 180 days bears interest of ‘LIBOR plus spread’ of

1.31% per annum secured against current assets.

(iii) During the previous year ended 31 March, 2017, The Department of Fertilizers, Government of India, has notified ‘Special Banking

Arrangement’ scheme to address the concern of delay in subsidy disbursement. This arrangement has been made by the Government

with the State Bank of India Consortium (SBI Consortium). Loans under this scheme are secured by hypothecation of subsidy receivables.

Fixed interest rate of 8.00% per annum out of which 6.25% per annum shall be borne by the government and repaid in April 2017. The

remaining 1.75% per annum shall be borne by the Company and will be recovered upfront for 60 days from the company at the time of

disbursement of the facility.

(iv) During the previous year ended 31 March, 2017, unsecured working capital demand loan of ` 50 crore was availed by the Company

repayable in May 2017. The loan bears interest of one month T-bill plus 0.05% per annum.

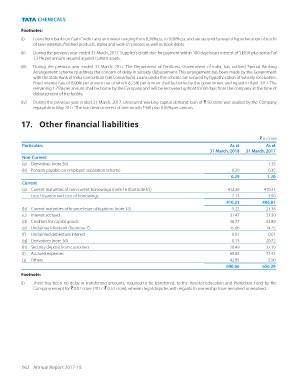

2WKHU ȴQDQFLDO OLDELOLWLHV

` in crore

Particulars As at As at

31 March, 2018 31 March, 2017

Non-Current

(a) Derivatives (note 36) - 1.35

(b) Pension payable on employee separation scheme 0.29 0.35

0.29 1.70

Current

(a) Current maturities of non-curent borrowings (note 16 (footnote ‘ii’)) 412.36 410.31

Less: Unamortised cost of borrowings 2.13 3.50

410.23 406.81

(b) Current maturities of finance lease obligations (note 33) 5.22 23.38

(c) Interest accrued 31.47 37.30

(d) Creditors for capital goods 36.77 32.89

(e) Unclaimed dividend (footnote ‘i’) 15.66 14.75

(f) Unclaimed debenture interest 0.01 0.01

(g) Derivatives (note 36) 0.13 20.72

(h) Security deposit from customers 28.49 37.10

(i) Accrued expenses 69.83 77.43

(j) Others 42.85 5.90

640.66 656.29

Footnote:

(i) There has been no delay in transferring amounts, required to be transferred, to the Investor Education and Protection Fund by the

Company except for ` 0.02 crore (2017: ` 0.53 crore), wherein legal disputes with regards to ownership have remained unresolved.

162 Annual Report 2017-18