Page 158 - Tata_Chemicals_yearly-reports-2017-18

P. 158

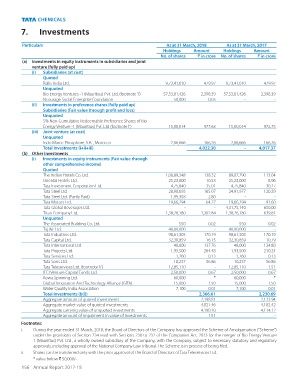

7. Investments

Particulars As at 31 March, 2018 As at 31 March, 2017

Holdings Amount Holdings Amount

No. of shares ` in crore No. of shares ` in crore

(a) Investments in equity instruments in subsidiaries and joint

venture (fully paid up)

(i) Subsidiaries (at cost)

Quoted

Rallis India Ltd. 9,73,41,610 479.97 9,73,41,610 479.97

Unquoted

Bio Energy Ventures -1 (Mauritius) Pvt. Ltd. (footnote ‘i’) 57,53,81,426 2,398.39 57,53,81,426 2,398.39

Ncourage Social Enterprise Foundation 50,000 0.05 - -

(ii) Investments in preference shares (fully paid up)

Subsidiaries (Fair value through profit and loss)

Unquoted

5% Non-Cumulative Redeemable Preference Shares of Bio

Energy Venture -1 (Mauritius) Pvt. Ltd (footnote ‘i’) 15,00,014 977.63 15,00,014 972.75

(iii) Joint venture (at cost)

Unquoted

Indo Maroc Phosphore, S.A. , Morocco 2,06,666 166.26 2,06,666 166.26

Total investments (i+ii+iii) 4,022.30 - 4,017.37

(b) Other investments

(i) Investments in equity instruments (Fair value through

other comprehensive income)

Quoted

The Indian Hotels Co. Ltd. 1,06,89,348 138.32 89,07,790 113.04

Oriental Hotels Ltd. 25,23,000 10.53 25,23,000 8.96

Tata Investment Corporation Ltd. 4,75,840 35.01 4,75,840 30.27

Tata Steel Ltd. 28,90,693 165.07 24,91,977 120.29

Tata Steel Ltd. (Partly Paid) 1,99,358 2.80 - -

Tata Motors Ltd. 19,66,294 64.27 19,66,294 91.60

Tata Global Beverages Ltd. - - 4,31,75,140 650.00

Titan Company Ltd. 1,38,26,180 1,302.84 1,38,26,180 639.81

Unquoted

The Associated Building Co. Ltd. 550 0.02 550 0.02

Taj Air Ltd. 40,00,000 - 40,00,000 -

Tata Industries Ltd. 98,61,303 170.19 98,61,303 170.19

Tata Capital Ltd. 32,30,859 16.15 32,30,859 10.79

Tata International Ltd. 48,000 137.76 48,000 124.80

Tata Projects Ltd. 1,93,500 264.48 1,93,500 210.24

Tata Services Ltd. 1,260 0.13 1,260 0.13

Tata Sons Ltd. 10,237 56.86 10,237 56.86

Tata Teleservices Ltd. (footnote ‘ii’) 12,85,110 - 12,85,110 1.51

IFCI Venture Capital Funds Ltd. 2,50,000 0.67 2,50,000 0.67

Kowa Spinning Ltd. 60,000 * 60,000 *

Global Innovation And Technology Alliance (GITA) 15,000 1.50 15,000 1.50

Water Quality India Association 7,100 0.01 7,100 0.01

Total investments (b(i)) 2,366.61 2,230.69

Aggregate amount of quoted investments 2,198.81 2,133.94

Aggregate market value of quoted investments 4,021.46 4,182.42

Aggregate carrying value of unquoted investments 4,190.10 4,114.12

Aggregate amount of impairment in value of Investments 1.51 -

Footnotes:

i. During the year ended 31 March, 2018, the Board of Directors of the Company has approved the Scheme of Amalgamation (“Scheme”)

under the provisions of Section 234 read with Sections 230 to 232 of the Companies Act, 2013 for the merger of Bio Energy Venture

1 (Mauritius) Pvt. Ltd., a wholly owned subsidiary of the Company, with the Company, subject to necessary statutory and regulatory

approvals, including approval of the National Company Law Tribunal. The Scheme is in process of being filed.

ii. Shares can be transferred only with the prior approval of the Board of Directors of Tata Teleservices Ltd.

* value below ` 50,000/-

156 Annual Report 2017-18