Page 336 - Tata Chemical Annual Report_2022-2023

P. 336

Integrated Annual Report 2022-23 01-83 84-192 193-365

Integrated Report Statutory Reports Financial Statements

Consolidated

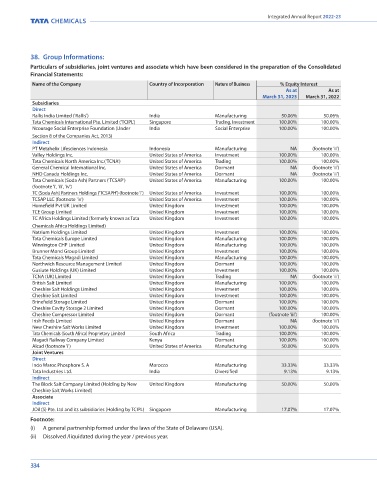

38. Group Informations: (iii) Subsequent to year end, Tata Chemicals (Soda Ash) Partners, (a general partnership formed under the laws of the State of

Particulars of subsidiaries, joint ventures and associate which have been considered in the preparation of the Consolidated Delaware - (USA) has been converted to a Limited Liability Corporation ("LLC") and renamed Tata Chemicals Soda Ash Partners LLC.

Financial Statements: (iv) Subsequent to year end, TCSAP LLC has been merged with Tata Chemicals Soda Ash Partners LLC.

Name of the Company Country of Incorporation Nature of Business % Equity Interest 39. Leases

As at As at

March 31, 2023 March 31, 2022 Maturity analysis of lease liabilities Year ended Year ended

Subsidiaries March 31, 2023 March 31, 2022

Direct

Rallis India Limited ('Rallis') India Manufacturing 50.06% 50.06% Maturity analysis – contractual undiscounted cash flows

Tata Chemicals International Pte. Limited ('TCIPL') Singapore Trading, Investment 100.00% 100.00% Less than one year 84 105

Ncourage Social Enterprise Foundation (Under India Social Enterprise 100.00% 100.00% One to five years 92 116

Section 8 of the Companies Act, 2013) More than five years 70 75

Indirect Total undiscounted lease liabilities 246 296

PT Metahelix Lifesciences Indonesia Indonesia Manufacturing NA (footnote 'ii')

Valley Holdings Inc. United States of America Investment 100.00% 100.00%

Tata Chemicals North America Inc.('TCNA') United States of America Trading 100.00% 100.00% Discounted Cash flows

General Chemical International Inc. United States of America Dormant NA (footnote 'ii') Current 76 87

NHO Canada Holdings Inc. United States of America Dormant NA (footnote 'ii') Non-Current 137 135

Tata Chemicals (Soda Ash) Partners ('TCSAP') United States of America Manufacturing 100.00% 100.00% Lease liabilities 213 222

(footnote 'i', 'iii', 'iv')

TC (Soda Ash) Partners Holdings ('TCSAPH') (footnote 'i') United States of America Investment 100.00% 100.00%

TCSAP LLC (footnote 'iv') United States of America Investment 100.00% 100.00% Expenses relating to short-term leases and low value assets have been disclosed under rent in note 33(d).

Homefield Pvt UK Limited United Kingdom Investment 100.00% 100.00%

TCE Group Limited United Kingdom Investment 100.00% 100.00% The incremental borrowing rate of 1.20% per annum to 13.00% per annum (2022: 1.20% per annum to 13.00% per annum) has been

TC Africa Holdings Limited (formerly known as Tata United Kingdom Investment 100.00% 100.00% applied to lease liabilities recognised in the Consolidated balance sheet.

Chemicals Africa Holdings Limited)

Natrium Holdings Limited United Kingdom Investment 100.00% 100.00% 40. Employee benefits obligations:

Tata Chemicals Europe Limited United Kingdom Manufacturing 100.00% 100.00% (A) In respect of the Company and domestic subsidiaries

Winnington CHP Limited United Kingdom Manufacturing 100.00% 100.00%

Brunner Mond Group Limited United Kingdom Investment 100.00% 100.00% The Company and its domestic subsidiaries make contributions towards provident fund, in substance a defined benefit retirement

Tata Chemicals Magadi Limited United Kingdom Manufacturing 100.00% 100.00% plan and towards pension and superannuation funds which are defined contribution retirement plans for qualifying employees. The

Northwich Resource Management Limited United Kingdom Dormant 100.00% 100.00% provident fund is administered by the Trustees of the Provident Fund and the superannuation fund is administered by the Trustees

Gusiute Holdings (UK) Limited United Kingdom Investment 100.00% 100.00%

TCNA (UK) Limited United Kingdom Trading NA (footnote 'ii') of the Superannuation Fund. The Company and its domestic subsidiaries are liable to pay to the provident fund to the extent of

British Salt Limited United Kingdom Manufacturing 100.00% 100.00% the amount contributed and any shortfall in the fund assets based on Government specified minimum rates of return relating to

Cheshire Salt Holdings Limited United Kingdom Investment 100.00% 100.00% current services. Such contribution and shortfall if any, are recognised as an expense in the year in which these are incurred.

Cheshire Salt Limited United Kingdom Investment 100.00% 100.00%

Brinefield Storage Limited United Kingdom Dormant 100.00% 100.00% On account of the above contribution plans, a sum of ` 19 crore (2022: ` 19 crore) has been charged to the Consolidated

Cheshire Cavity Storage 2 Limited United Kingdom Dormant 100.00% 100.00% Statement of Profit and Loss.

Cheshire Compressor Limited United Kingdom Dormant (footnote 'iii') 100.00%

Irish Feeds Limited United Kingdom Dormant NA (footnote 'ii')

New Cheshire Salt Works Limited United Kingdom Investment 100.00% 100.00% The Company and its domestic subsidiaries make annual contributions to the Employees' Gratuity Trust and to the Employees'

Tata Chemicals (South Africa) Proprietary Limited South Africa Trading 100.00% 100.00% Group Gratuity-cum-Life Assurance Scheme of the Life Insurance Corporation of India, for funding the defined benefit plans

Magadi Railway Company Limited Kenya Dormant 100.00% 100.00% for qualifying employees. The scheme provides for lump sum payment to vested employees at retirement or death while in

Alcad (footnote 'i') United States of America Manufacturing 50.00% 50.00% employment or on termination of employment. Employees, upon completion of the vesting period, are entitled to a benefit

Joint Ventures

Direct equivalent to either half month, three fourth month and full month salary last drawn for each completed year of service

Indo Maroc Phosphore S. A Morocco Manufacturing 33.33% 33.33% depending upon the completed years of continuous service in case of retirement or death while in employment. In case of

Tata Industries Ltd. India Diversified 9.13% 9.13% termination, the benefit is equivalent to fifteen days salary last drawn for each completed year of service in line with the Payment

Indirect of Gratuity Act, 1972. Vesting occurs upon completion of five years of continuous service.

The Block Salt Company Limited (Holding by New United Kingdom Manufacturing 50.00% 50.00%

Cheshire Salt Works Limited)

Associate The trustees of the trust fund are responsible for the overall governance of the plan and to act in accordance with the provisions

Indirect of the trust deed and rules in the best interests of the plan participants. They are tasked with periodic reviews of the solvency

JOil (S) Pte. Ltd and its subsidiaries (Holding by TCIPL) Singapore Manufacturing 17.07% 17.07% of the fund and play a role in the long-term investment, risk management and funding strategy.

Footnote:

(i) A general partnership formed under the laws of the State of Delaware (USA). The Company also provides post retirement medical benefits to eligible employees under which employees at Mithapur who

have retired from service of the Company are entitled for free medical facility at the Company hospital during their lifetime.

(ii) Dissolved /liquidated during the year / previous year.

Other employees are entitled to domiciliary treatment exceeding the entitled limits for the treatments covered under the

334 335