Page 331 - Tata Chemical Annual Report_2022-2023

P. 331

Integrated Annual Report 2022-23 01-83 84-192 193-365

Integrated Report Statutory Reports Financial Statements

Consolidated

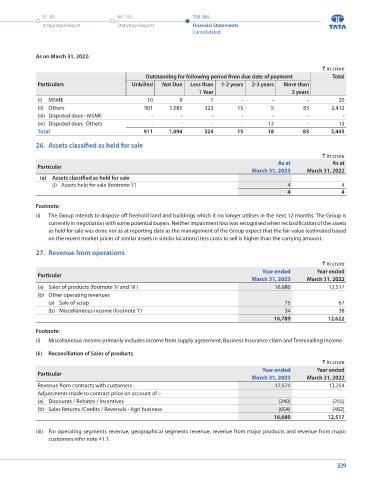

23. Other liabilities As on March 31, 2022:

` in crore ` in crore

As at As at Outstanding for following period from due date of payment Total

Particular

March 31, 2023 March 31, 2022 Particulars Unbilled Not Due Less than 1-2 years 2-3 years More than

Non-current 1 Year 3 years

(a) Deferred income (including government grants) 364 367 (i) MSME 10 9 1 - - - 20

(b) Others 60 30 (ii) Others 901 1,085 323 15 5 83 2,412

424 397 (iii) Disputed dues - MSME - - - - - - -

Current (iv) Disputed dues -Others - - - - 13 - 13

(a) Statutory dues 146 161 Total 911 1,094 324 15 18 83 2,445

(b) Advance received from customers 118 144

(c) Deferred income (including government grants and emission trading allowance) 220 210 26. Assets classified as held for sale

(d) Others 37 21

521 536 ` in crore

Particular As at As at

24. Tax assets and liabilities March 31, 2023 March 31, 2022

(a) Assets classified as held for sale

` in crore (i) Assets held for sale (footnote 'i') 4 4

As at As at

Particular 4 4

March 31, 2023 March 31, 2022

(a) Tax assets Footnote:

Non-current (i) The Group intends to dispose off freehold land and buildings which it no longer utilises in the next 12 months. The Group is

(i) Advance tax assets (net) 767 707

Current currently in negotiation with some potential buyers. Neither impairment loss was recognised when reclassification of the assets

(i) Current tax assets (net) - 1 as held for sale was done nor as at reporting date as the management of the Group expect that the fair value (estimated based

(b) Current tax liabilities (net) 119 122 on the recent market prices of similar assets in similar locations) less costs to sell is higher than the carrying amount.

25. Trade payables 27. Revenue from operations

` in crore ` in crore

As at As at Year ended Year ended

Particular Particular

March 31, 2023 March 31, 2022 March 31, 2023 March 31, 2022

(a) Trade payables 2,363 2,425 (a) Sales of products (footnote 'ii' and 'iii') 16,680 12,517

(b) Acceptances (footnote 'i') 213 - (b) Other operating revenues

(c) Amount due to micro enterprises and small enterprises 21 20 (a) Sale of scrap 75 67

2,597 2,445 (b) Miscellaneous income (footnote 'i') 34 38

16,789 12,622

Footnote:

(i) Acceptances includes credit availed by the suppliers from banks for goods supplied to the Company. The arrangements are Footnote:

interest bearing, where the Company bears the interest cost and are payable within one year. (i) Miscellaneous income primarily includes income from supply agreement, Business Insurance claim and Terminalling Income.

Trade Payable ageing schedule: (ii) Reconciliation of Sales of products

As on March 31, 2023: ` in crore

` in crore Particular Year ended Year ended

Outstanding for following period from due date of payment Total March 31, 2023 March 31, 2022

Particulars Unbilled Not Due Less than 1-2 years 2-3 years More than Revenue from contracts with customers 17,574 13,254

1 Year 3 years Adjustments made to contract price on account of :-

(i) MSME - 16 5 - - - 21 (a) Discounts / Rebates / Incentives (240) (255)

(ii) Others 429 1,549 496 19 10 73 2,576 (b) Sales Returns /Credits / Reversals - Agri business (654) (482)

(iii) Disputed dues - MSME - - - - - - - 16,680 12,517

(iv) Disputed dues -Others - - - - - - - (iii) For operating segments revenue, geographical segments revenue, revenue from major products and revenue from major

Total 429 1,565 501 19 10 73 2,597

customers refer note 41.1.

328 329