Page 332 - Tata Chemical Annual Report_2022-2023

P. 332

Integrated Annual Report 2022-23 01-83 84-192 193-365

Integrated Report Statutory Reports Financial Statements

Consolidated

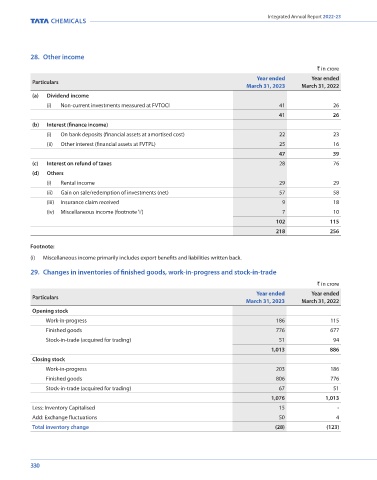

28. Other income 30. Employee benefits expense

` in crore

` in crore

Year ended Year ended Particulars Year ended Year ended

Particulars March 31, 2023 March 31, 2022

March 31, 2023 March 31, 2022

(a) Salaries, wages and bonus 1,337 1,222

(a) Dividend income (b) Contribution to provident and other funds 130 149

(i) Non-current investments measured at FVTOCI 41 26 (c) Staff welfare expense 224 169

41 26 1,691 1,540

(b) Interest (finance income) The Indian Parliament has approved the Code on Social Security, 2020 which would impact the contributions by the company towards

Provident Fund and Gratuity. The Ministry of Labour and Employment has released draft rules for the Code on Social Security, 2020 on

(i) On bank deposits (financial assets at amortised cost) 22 23 November 13, 2020, and has invited suggestions from stakeholders which are under active consideration by the Ministry. The Company

(ii) Other interest (financial assets at FVTPL) 25 16 and its Indian subsidiaries will assess the impact and its evaluation once the subject rules are notified and will give appropriate impact in its

financial statements in the period in which, the Code becomes effective and the related rules to determine the financial impact are published.

47 39

(c) Interest on refund of taxes 28 76 31. Finance costs

` in crore

(d) Others Year ended Year ended

(i) Rental income 29 29 Particulars March 31, 2023 March 31, 2022

(ii) Gain on sale/redemption of investments (net) 57 58 (a) Interest costs

(i) Interest on loans at amortised cost 315 219

(iii) Insurance claim received 9 18

(ii) Interest on obligations under leases (note 39) 10 8

(iv) Miscellaneous income (footnote 'i') 7 10 (b) Discounting and other charges 81 76

102 115 406 303

218 256 32. Depreciation and amortisation expense

` in crore

Footnote: Year ended Year ended

Particulars

(i) Miscellaneous income primarily includes export benefits and liabilities written back. March 31, 2023 March 31, 2022

(a) Depreciation of property, plant and equipment 674 602

29. Changes in inventories of finished goods, work-in-progress and stock-in-trade (b) Depreciation of Investment property 2 1

(c) Amortisation of right-of-use assets 107 99

` in crore (d) Amortisation of intangible assets 109 104

Year ended Year ended 892 806

Particulars

March 31, 2023 March 31, 2022 33. Other expenses

Opening stock ` in crore

Work-in-progress 186 115 Particulars Year ended Year ended

Finished goods 776 677 (a) Stores and spare parts consumed March 31, 2023 March 31, 2022

348

273

Stock-in-trade (acquired for trading) 51 94 (b) Packing materials consumed 318 319

(c) Repairs - Buildings 10 21

1,013 886

- Machinery 572 417

Closing stock - Others 11 10

Work-in-progress 203 186 (d) Rent 50 43

(e) Royalty, rates and taxes 518 378

Finished goods 806 776 (f) Distributor's service charges 5 3

Stock-in-trade (acquired for trading) 67 51 (g) Sales promotion expenses 135 77

(h) Insurance charges 91 82

1,076 1,013 (i) Loss on assets sold, discarded or written off (net) (footnote 'ii') 28 14

Less: Inventory Capitalised 15 - (j) Bad debts written off 3 18

(k) Provision for doubtful debts, advances and other receivables (net) 6 (4)

Add: Exchange fluctuations 50 4

(l) Foreign exchange loss (net) 30 7

Total inventory change (28) (123) (m) Director's fees and commission 6 7

(n) Others (footnote 'i') 690 557

2,821 2,222

330 331