Page 334 - Tata Chemical Annual Report_2022-2023

P. 334

Integrated Annual Report 2022-23 01-83 84-192 193-365

Integrated Report Statutory Reports Financial Statements

Consolidated

Footnote: 36. Discontinued operations

(i) Exceptional gain from discontinued operations for the year ended March 31, 2022 is in respect of subsidy for previous years

` in crore

Year ended Year ended pertaining to the erstwhile fertilizer business, which is received in the current period from the transferor pursuant to the

Particulars Business transfer agreement.

March 31, 2023 March 31, 2022

(i) Auditors' remuneration

(a) For services as auditor 13 13 (ii) Share of (loss)/profit of joint ventures from discontinued operations (net of tax) includes (loss)/profit from Tata Industries

(b) For other services (including certification) 1 1 Limited (a joint venture of the Group).

(c) For reimbursement of expenses * *

14 14 37. Earnings per share

Year ended Year ended

* value below ` 0.50 crore. Particulars

March 31, 2023 March 31, 2022

(ii) Includes Impairment of Intangible under development of ` 30 crore (2022: ` NIL) (Refer note 8(b)) Basic and Diluted earnings per share (`)

From continuing operations (`) 91.66 49.17

34. Exceptional item (net)

From discontinued operations (`) (0.71) 0.20

During the previous year, Consequent to the restructuring announcement made by one of the subsidiary, the Group had offered

severance pay to employees and the same is disclosed as exceptional item from continuing operations. Total Basic and Diluted earnings per share (`) 90.95 49.37

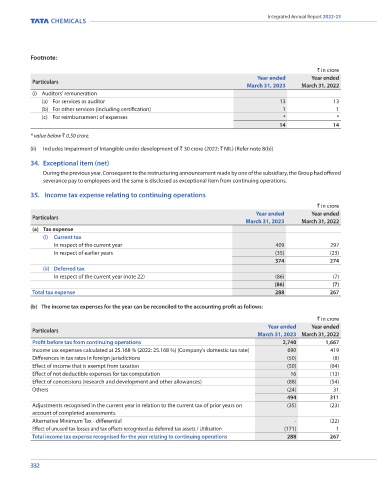

35. Income tax expense relating to continuing operations Footnote:

The earnings and weighted average numbers of equity shares used in the calculation of basic and diluted earnings per share are

` in crore as follows.

Year ended Year ended

Particulars

March 31, 2023 March 31, 2022 (a) Earnings used in the calculation of basic and diluted earnings per share:

(a) Tax expense

(i) Current tax ` in crore

In respect of the current year 409 297 Year ended Year ended

In respect of earlier years (35) (23) Particulars March 31, 2023 March 31, 2022

374 274 Profit for the year from continuing operations attributable to equity shareholders of 2,335 1,253

(ii) Deferred tax the Company

In respect of the current year (note 22) (86) (7) (Loss)/profit for the year from discontinued operations attributable to equity (18) 5

(86) (7) shareholders of the Company

Total tax expense 288 267

2,317 1,258

(b) The income tax expenses for the year can be reconciled to the accounting profit as follows:

(b) Weighted average number of equity shares used in the calculation of basic and diluted earnings per share:

` in crore

Year ended Year ended Particulars No. of shares No. of shares

Particulars

March 31, 2023 March 31, 2022 Weighted average number of equity shares used in the calculation of basic and diluted 25,47,56,278 25,47,56,278

Profit before tax from continuing operations 2,740 1,667 earnings per share from continuing operations and from discontinued operations

Income tax expenses calculated at 25.168 % (2022: 25.168 %) (Company's domestic tax rate) 690 419

Differences in tax rates in foreign jurisdictions (50) (8)

Effect of income that is exempt from taxation (50) (64)

Effect of not deductible expenses for tax computation 16 (13)

Effect of concessions (research and development and other allowances) (88) (54)

Others (24) 31

494 311

Adjustments recognised in the current year in relation to the current tax of prior years on (35) (23)

account of completed assessments.

Alternative Minimum Tax - differential - (22)

Effect of unused tax losses and tax offsets recognised as deferred tax assets / Utilisation (171) 1

Total income tax expense recognised for the year relating to continuing operations 288 267

332 333