Page 322 - Tata Chemical Annual Report_2022-2023

P. 322

Integrated Annual Report 2022-23 01-83 84-192 193-365

Integrated Report Statutory Reports Financial Statements

Consolidated

` in crore ` in crore

As at March 31, 2023 As at March 31, 2022 As at March 31, 2023 As at March 31, 2022

Particulars Non - Current Non - Current Particulars Non - Current Non - Current

Current Current Current Current

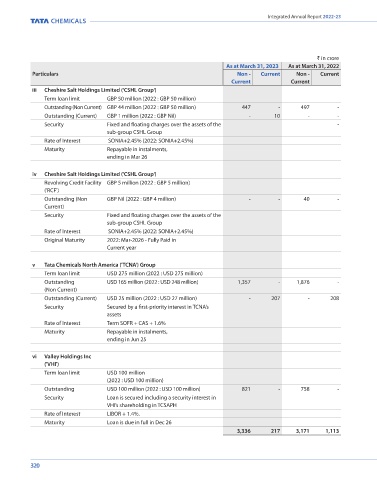

iii Cheshire Salt Holdings Limited ('CSHL Group') b Unsecured : Term loans - bank

Term loan limit GBP 50 million (2022 : GBP 50 million) i Homefield Private UK Ltd

Outstanding (Non Current) GBP 44 million (2022 : GBP 50 million) 447 - 497 - Term loan limit USD 45.5 million (2022 : USD 45.5 million)

Outstanding (Current) GBP 1 million (2022 : GBP Nil) - 10 - - Outstanding USD 45.5 million (2022 : USD 45.5 million) 373 - 344 -

Security Fixed and floating charges over the assets of the - Rate of Interest SOFR + CAS + 1.25%

sub-group CSHL Group Maturity Loan is due in full in Dec 26

Rate of Interest SONIA+2.45% (2022: SONIA+2.45%)

Maturity Repayable in instalments, ii Homefield Private UK Ltd

ending in Mar 26 Term loan USD 28.5 million (2022 : USD 28.5 million)

Outstanding USD Nil (2022 : USD 28.5 million) - - - 216

iv Cheshire Salt Holdings Limited ('CSHL Group') Rate of Interest Not Applicable (2022 : LIBOR + 1.15%)

Revolving Credit Facility GBP 5 million (2022 : GBP 5 million) Repayment Loan fully repaid in Oct 22

('RCF')

Outstanding (Non GBP Nil (2022 : GBP 4 million) - - 40 - iii Rallis India Limited ('Rallis'):

Current) Term loan limit ` 15 crore

Security Fixed and floating charges over the assets of the Outstanding - - - 3

sub-group CSHL Group

Rate of Interest SONIA+2.45% (2022: SONIA+2.45%) Rate of Interest Effective weighted average interest rate was

7.58%.

Original Maturity 2022: Mar-2026 - Fully Paid in Repayment schedule The repayment began after a moratorium of 24 months

Current year

from February 2018 - Loan paid in current year.

v Tata Chemicals North America ('TCNA') Group iv Tata Chemicals Magadi Limited

Term loan limit USD 275 million (2022 : USD 275 million) Term loan limit USD Nil (2022 : USD 46 million)

Outstanding USD 165 million (2022 : USD 248 million) 1,357 - 1,876 - Outstanding USD Nil (2022 : USD 36 million) - - 273 -

(Non Current)

Outstanding (Current) USD 25 million (2022 : USD 27 million) - 207 - 208 Rate of Interest LIBOR + 1.80%

Security Secured by a first-priority interest in TCNA’s Repayment Loan fully repaid in FY 22-23

assets

Rate of Interest Term SOFR + CAS + 1.6% v Tata Chemicals International Pte. Limited ('TCIPL'):

Maturity Repayable in instalments, Term loan limit USD 228.5 million (2022 : USD 200 million)

ending in Jun 25 Outstanding USD 228.5 million 1,878 - - 1,516

(2022 : USD 200 million)

Rate of Interest SOFR + 1.18% (2022 : LIBOR + 1.20%)

vi Valley Holdings Inc

('VHI') Maturity Loan is due in full in Sep 24

Term loan limit USD 100 million

(2022 : USD 100 million) vi Tata Chemicals North America ('TCNA') Group

Outstanding USD 100 million (2022 : USD 100 million) 821 - 758 - RCF limit USD 25 million (2022 : USD Nil)

Security Loan is secured including a security interest in Outstanding USD 15 million (2022 : USD Nil) - 123 - -

VHI’s shareholding in TCSAPH Rate of Interest SOFR + 1.25% (2022 : Nil)

Rate of Interest LIBOR + 1.4%. Maturity This facility will expire in May-24

Maturity Loan is due in full in Dec 26

3,336 217 3,171 1,113

320 321