Page 325 - Tata Chemical Annual Report_2022-2023

P. 325

Integrated Annual Report 2022-23 01-83 84-192 193-365

Integrated Report Statutory Reports Financial Statements

Consolidated

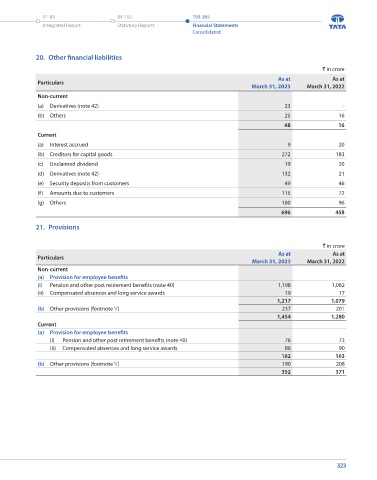

` in crore 20. Other financial liabilities

As at March 31, 2023 As at March 31, 2022 ` in crore

Particulars Non - Current Non - Current

Current Current Particulars As at As at

vii Natrium Holdings and its subsidiaries March 31, 2023 March 31, 2022

Uncommitted GBP 40 million (2022 : GBP Nil) Non-current

Facility limit (a) Derivatives (note 42) 23 -

Outstanding GBP 10 million (2022 : GBP Nil) - 102 - - (b) Others 25 16

Rate of Interest SONIA+CAS+1.15% 48 16

Maturity This facility will due for repayment in FY23-24

2,251 225 617 1,735 Current

(a) Interest accrued 9 20

c Unsecured : Other loans (b) Creditors for capital goods 272 183

i Rallis (c) Unclaimed dividend 19 20

Sales Tax deferral scheme loan (d) Derivatives (note 42) 132 21

Outstanding 3 1 4 1

Rate of Interest Interest free Sales tax deferral (e) Security deposits from customers 49 46

scheme loan (f) Amounts due to customers 115 72

Maturity Repayable in annual instalments which range (g) Others 100 96

from a maximum of ` 1.03 crore to a minimum 696 458

of ` 0.24 crore over the period FY2024 to

FY2027. 21. Provisions

3 1 4 1

d Secured : Working capital demand loan

i Tata Chemicals Magadi Limited ` in crore

Secured overdraft facility Particulars As at As at

Outstanding - - - 4 March 31, 2023 March 31, 2022

Security Secured against dues receivable from Kenyan Non-current

Revenue Authority (a) Provision for employee benefits

Rate of Interest 7% (i) Pension and other post retirement benefits (note 40) 1,198 1,062

Repayment Repaid in full in FY 22-23 (ii) Compensated absences and long service awards 19 17

1,217 1,079

ii Rallis (b) Other provisions (footnote 'i') 237 201

Short term loan 1,454 1,280

Outstanding - 100 - 50 Current

Security First pari-passu charge on stock (including raw (a) Provision for employee benefits

material, finished goods and work-in-progress) (i) Pension and other post retirement benefits (note 40) 76 73

and book debts. (ii) Compensated absences and long service awards 86 90

Rate of Interest Effective weighted average rate was 5.94%. 162 163

Maturity This facility will due for repayment in FY23-24 (b) Other provisions (footnote 'i') 190 208

- 100 - 54 352 371

e Unsecured : Working capital demand loan

i TCIPL

Working Capital Demand Loan

Outstanding USD Nil (2022 : USD 24 million) - - - 182

Rate of Interest Interest is charged at 0.86% to 2.98% (2022:

0.67% to 1.21%) per annum.

Maturity Repaid in full in FY 22-23

- - - 182

322 323