Page 321 - Tata Chemical Annual Report_2022-2023

P. 321

Integrated Annual Report 2022-23 01-83 84-192 193-365

Integrated Report Statutory Reports Financial Statements

Consolidated

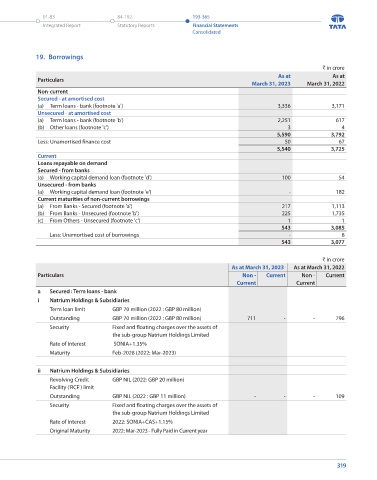

Summarised statement of profit and loss 19. Borrowings

` in crore ` in crore

Year ended Year ended As at As at

Particulars Particulars

March 31, 2023 March 31, 2022 March 31, 2023 March 31, 2022

Revenue and other income 2,980 2,631 Non-current

Cost of raw material consumed (1,701) (1,562) Secured - at amortised cost

Purchase of stock-in-trade (158) (120) (a) Term loans - bank (footnote 'a') 3,336 3,171

Changes in inventories of finished goods, work-in-progress and stock-in-trade (85) 58 Unsecured - at amortised cost

Employee benefits expense (256) (239)

Finance cost (12) (5) (a) Term loans - bank (footnote 'b') 2,251 617

Depreciation and amortisation (91) (74) (b) Other loans (footnote 'c') 3 4

Other expenses and exceptional items (549) (467) 5,590 3,792

Profit before tax 128 222 Less: Unamortised finance cost 50 67

Income tax expense (36) (58) 5,540 3,725

Profit after tax for the year 92 164 Current

Fair Value Adjustments for NCI (Ind-AS 103) - - Loans repayable on demand

Profit for the year 92 164 Secured - from banks

% Holding by the Non-controlling shareholders 49.94% 49.94%

NCI’s share of profit for the year 46 81 (a) Working capital demand loan (footnote 'd') 100 54

Unsecured - from banks

Summarised statement of Cash flows (a) Working capital demand loan (footnote 'e') - 182

` in crore Current maturities of non-current borrowings

Year ended Year ended (a) From Banks - Secured (footnote 'a') 217 1,113

Particulars (b) From Banks - Unsecured (footnote 'b') 225 1,735

March 31, 2023 March 31, 2022

Net cash flows generated from operating activities 217 166 (c) From Others - Unsecured (footnote 'c') 1 1

Net cash flows used in investing activities (142) (103) 543 3,085

Net cash flows used in financing activities (41) (61) Less: Unamortised cost of borrowings - 8

Net increase in cash and cash equivalents 34 2 543 3,077

Note - ii

` in crore

ALCAD

As at March 31, 2023 As at March 31, 2022

Movement of Non-controlling interest Particulars Non - Current Non - Current

` in crore Current Current

Year ended Year ended

Particulars a Secured : Term loans - bank

March 31, 2023 March 31, 2022

Opening carrying value as at April 1 - - i Natrium Holdings & Subsidiaries

NCI’s share of profit for the year 71 66 Term loan limit GBP 70 million (2022 : GBP 80 million)

Dividend received for the year (71) (66) Outstanding GBP 70 million (2022 : GBP 80 million) 711 - - 796

Closing carrying value as at March 31 - -

Security Fixed and floating charges over the assets of

Summarised statement of profit and loss the sub-group Natrium Holdings Limited

Rate of Interest SONIA+1.35%

` in crore

Year ended Year ended Maturity Feb-2028 (2022: Mar-2023)

Particulars

March 31, 2023 March 31, 2022

Revenue and other income 433 397 ii Natrium Holdings & Subsidiaries

Cost of sales (291) (266)

Profit before tax 142 131 Revolving Credit GBP NIL (2022: GBP 20 million)

Income tax expense - - Facility ('RCF') limit

Profit for the year 142 131 Outstanding GBP NIL (2022 : GBP 11 million) - - - 109

% Holding by the Non-controlling shareholders 50.00% 50.00%

NCI’s share of profit for the year 71 66 Security Fixed and floating charges over the assets of

the sub-group Natrium Holdings Limited

Rate of Interest 2022: SONIA+CAS+1.15%

Original Maturity 2022: Mar-2023 - Fully Paid in Current year

318 319