Page 314 - Tata Chemical Annual Report_2022-2023

P. 314

Integrated Annual Report 2022-23 01-83 84-192 193-365

Integrated Report Statutory Reports Financial Statements

Consolidated

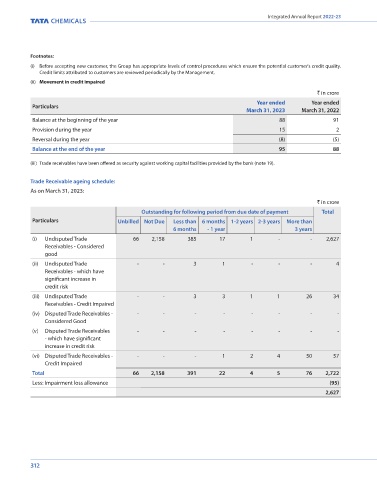

Footnotes: As on March 31, 2022:

(i) Before accepting new customer, the Group has appropriate levels of control procedures which ensure the potential customer's credit quality. ` in crore

Credit limits attributed to customers are reviewed periodically by the Management. Outstanding for following period from due date of payment Total

(ii) Movement in credit impaired Particulars Unbilled Not Due Less than 6 months - 1-2 2-3 years More than

6 months 1 year years 3 years

` in crore

(i) Undisputed Trade 21 1,642 259 2 5 2 2 1,933

Year ended Year ended

Particulars Receivables -

March 31, 2023 March 31, 2022 Considered good

Balance at the beginning of the year 88 91 (ii) Undisputed Trade - - 2 3 - - 1 6

Provision during the year 15 2 Receivables - which have

significant increase in credit

Reversal during the year (8) (5)

risk

Balance at the end of the year 95 88 (iii) Undisputed Trade - - 1 - 1 1 23 26

Receivables - Credit

(iii) Trade receivables have been offered as security against working capital facilities provided by the bank (note 19).

Impaired

(ii) Disputed Trade Receivables - - - - - - - -

Trade Receivable ageing schedule: - Considered Good

As on March 31, 2023: (v) Disputed Trade Receivables - - - - 1 - - 1

- which have significant

` in crore

increase in

Outstanding for following period from due date of payment Total credit risk

Particulars Unbilled Not Due Less than 6 months 1-2 years 2-3 years More than (vi) Disputed Trade Receivables - - 1 1 3 3 47 55

6 months - 1 year 3 years - Credit Impaired

(i) Undisputed Trade 66 2,158 385 17 1 - - 2,627 Total 21 1,642 263 6 10 6 73 2,021

Receivables - Considered Less: Impairment loss allowance (88)

good 1,933

(ii) Undisputed Trade - - 3 1 - - - 4

Receivables - which have 15. Cash and cash equivalents and other bank balances

significant increase in ` in crore

credit risk As at As at

Particulars

(iii) Undisputed Trade - - 3 3 1 1 26 34 March 31, 2023 March 31, 2022

Receivables - Credit Impaired Cash and cash equivalents:

(iv) Disputed Trade Receivables - - - - - - - - - (a) Balance with banks 193 326

Considered Good (b) Cash on hand - -

(v) Disputed Trade Receivables - - - - - - - - (c) Deposit accounts (with original maturity less than 3 months) 315 436

- which have significant Cash and cash equivalents as per Statement of Cash Flow 508 762

increase in credit risk Other bank balances:

(vi) Disputed Trade Receivables - - - - 1 2 4 50 57 (a) Earmarked balances with banks 19 20

Credit Impaired (b) Deposit accounts (other than (c) above, with maturity less than 12 months from the balance

Total 66 2,158 391 22 4 5 76 2,722 sheet date) 138 529

Less: Impairment loss allowance (95) 157 549

2,627 Footnotes:

(i) Non cash transactions

The Group has not entered into non cash investing and financing activities, except as disclosed in the Consolidated Statement

of Cash Flows (Reconciliation of borrowings and lease liabilities).

312 313