Page 313 - Tata Chemical Annual Report_2022-2023

P. 313

Integrated Annual Report 2022-23 01-83 84-192 193-365

Integrated Report Statutory Reports Financial Statements

Consolidated

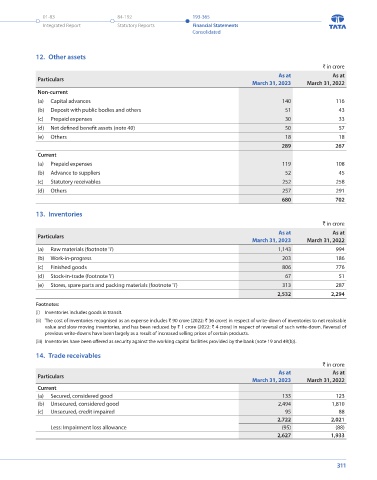

As at As at 12. Other assets

March 31, 2023 March 31, 2022 ` in crore

Particulars

Holdings Amount Holdings Amount As at As at

No. of securities ` in crore No. of securities ` in crore Particulars

March 31, 2023 March 31, 2022

(iv) Investment in perpetual instrument Non-current

(Fair value through profit and loss)

Tata International Ltd. (Unquoted) - 150 - (a) Capital advances 140 116

Total investments (iv) 150 - (b) Deposit with public bodies and others 51 43

Total investments (i + ii + iii + iv) 5,042 5,124 (c) Prepaid expenses 30 33

Aggregate amount of quoted investments (i) 4,364 4,504 (d) Net defined benefit assets (note 40) 50 57

Aggregate market value of quoted investments (i) 4,364 4,504 (e) Others 18 18

Aggregate carrying value of unquoted investments (ii) 678 620 289 267

* value below ` 0.50 crore Current

(a) Prepaid expenses 119 108

9. (d) Current investments (Fair value through profit and loss) (note 49(d))

` in crore (b) Advance to suppliers 52 45

As at As at (c) Statutory receivables 252 258

Particulars

March 31, 2023 March 31, 2022 (d) Others 257 291

Investment in mutual funds - unquoted 1,231 1,325 680 702

Investment in Non convertible Debentures - quoted 39 -

Total current investments 1,270 1,325 13. Inventories

` in crore

10. Loans As at As at

` in crore Particulars March 31, 2023 March 31, 2022

As at As at

Particulars (a) Raw materials (footnote 'i') 1,143 994

March 31, 2023 March 31, 2022

Current (b) Work-in-progress 203 186

(Unsecured, considered good) (c) Finished goods 806 776

Inter-corporate Deposits (note 49(d)) 325 - (d) Stock-in-trade (footnote 'i') 67 51

325 - (e) Stores, spare parts and packing materials (footnote 'i') 313 287

Footnote: 2,532 2,294

(i) Loans to employees includes ` NIL (2022: ` NIL) due from officer of the Company. Maximum balance outstanding during the year is ` * (2022: ` *) Footnotes:

* value below ` 0.50 crore (i) Inventories includes goods in transit.

(ii) The cost of inventories recognised as an expense includes ` 90 crore (2022: ` 36 crore) in respect of write-down of inventories to net realisable

11. Other financial assets value and slow moving inventories, and has been reduced by ` 1 crore (2022: ` 4 crore) in respect of reversal of such write-down. Reversal of

` in crore previous write-downs have been largely as a result of increased selling prices of certain products.

As at As at (iii) Inventories have been offered as security against the working capital facilities provided by the bank (note 19 and 49(b)).

Particulars

March 31, 2023 March 31, 2022

Non-current 14. Trade receivables

(a) Fixed deposits with banks 7 26 ` in crore

(b) Deposit with others 25 9 Particulars As at As at

(c) Derivatives (note 42) 8 3 March 31, 2023 March 31, 2022

(d) Others - 16 Current

40 54 (a) Secured, considered good 133 123

Current (b) Unsecured, considered good 2,494 1,810

(a) Derivatives (note 42) 22 975 (c) Unsecured, credit impaired 95 88

(b) Accrued income 37 160 2,722 2,021

(c) Subsidy receivable (net) and Others 2 40

61 1,175 Less: Impairment loss allowance (95) (88)

2,627 1,933

310 311