Page 306 - Tata Chemical Annual Report_2022-2023

P. 306

Integrated Annual Report 2022-23 01-83 84-192 193-365

Integrated Report Statutory Reports Financial Statements

Consolidated

7(b). Goodwill As on March 31, 2023:

Goodwill of ` 46 crore (2022: ` 46 crore) relates to the precipitated silica business. The estimated value in use of the CGU is based on Ageing Schedule ` in crore

future cash flows of forecasted period of 20 years and discount rate of 11.8%, which consider the operating and macro-economic Particulars Less than 1 Year 1-2 Years 2-3 Years More than 3 Years Total

environment in which the entity operates.

Projects in Progress 18 12 15 14 59

An analysis of the sensitivity of the change in key parameters (operating margin, discount rates and long term average growth rate), Total 18 12 15 14 59

based on reasonably probable assumptions, did not result in any probable scenario in which the recoverable amount of the CGU

would decrease below the carrying amount. As on March 31, 2022:

Ageing Schedule ` in crore

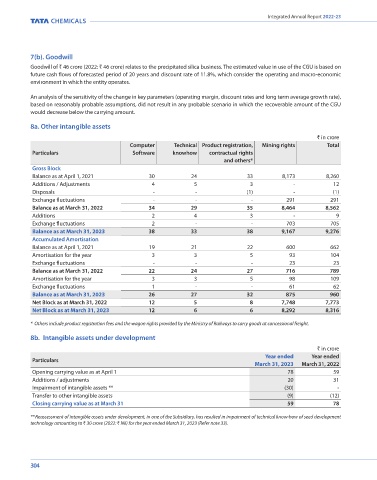

8a. Other intangible assets

Particulars Less than 1 Year 1-2 Years 2-3 Years More than 3 Years Total

` in crore

Computer Technical Product registration, Mining rights Total Projects in Progress 28 22 15 13 78

Particulars Software knowhow contractual rights Total 28 22 15 13 78

and others*

Gross Block 9(a). Investments in joint ventures (note 49(d))

Balance as at April 1, 2021 30 24 33 8,173 8,260 The Group’s interest in joint ventures are accounted for using the equity method in the Consolidated Financial Statements.

Additions / Adjustments 4 5 3 - 12

Disposals - - (1) - (1) Following are details of investments in Joint ventures:

Exchange fluctuations - - - 291 291 Percentage of ownership Interest

Balance as at March 31, 2022 34 29 35 8,464 8,562 Particulars

Additions 2 4 3 - 9 Country of incorporation March 31, 2023 March 31, 2022

Exchange fluctuations 2 - - 703 705 Indo Maroc Phosphore S.A. ('IMACID') Morocco 33.33% 33.33%

Balance as at March 31, 2023 38 33 38 9,167 9,276 Tata Industries Ltd. India 9.13% 9.13%

Accumulated Amortisation The Block Salt Company Ltd. United Kingdom 50.00% 50.00%

Balance as at April 1, 2021 19 21 22 600 662

Amortisation for the year 3 3 5 93 104 The Group had no contingent liabilities or capital commitments relating to its interest in joint ventures as at March 31, 2023 and 2022.

Exchange fluctuations - - - 23 23 The joint ventures have no other contingent liabilities or capital commitments as at March 31, 2023 and 2022.

Balance as at March 31, 2022 22 24 27 716 789 Carrying amount of investment in joint ventures

Amortisation for the year 3 3 5 98 109

Exchange fluctuations 1 - - 61 62 ` in crore

Balance as at March 31, 2023 26 27 32 875 960 Particulars March 31, 2023 March 31, 2022

Net Block as at March 31, 2022 12 5 8 7,748 7,773 Indo Maroc Phosphore S.A. 652 672

Net Block as at March 31, 2023 12 6 6 8,292 8,316 Tata Industries Ltd. 484 561

The Block Salt Company Ltd. - 1

* Others include product registration fees and the wagon rights provided by the Ministry of Railways to carry goods at concessional freight.

Total 1,136 1,234

8b. Intangible assets under development

` in crore

Year ended Year ended

Particulars

March 31, 2023 March 31, 2022

Opening carrying value as at April 1 78 59

Additions / adjustments 20 31

Impairment of intangible assets ** (30) -

Transfer to other intangible assets (9) (12)

Closing carrying value as at March 31 59 78

**Reassessment of intangible assets under development, in one of the Subsidiary, has resulted in impairment of technical know-how of seed development

technology amounting to ` 30 crore (2022: ` Nil) for the year ended March 31, 2023 (Refer note 33).

304 305