Page 305 - Tata Chemical Annual Report_2022-2023

P. 305

Integrated Annual Report 2022-23 01-83 84-192 193-365

Integrated Report Statutory Reports Financial Statements

Consolidated

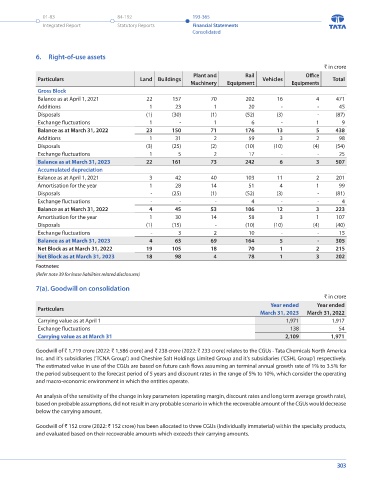

5. Investment property 6. Right-of-use assets

` in crore ` in crore

Particulars Land Building Total Particulars Land Buildings Plant and Rail Vehicles Office Total

Gross Block Machinery Equipment Equipments

Balance as at April 1, 2021 17 48 65 Gross Block

Additions - - - Balance as at April 1, 2021 22 157 70 202 16 4 471

Balance as at March 31, 2022 17 48 65 Additions 1 23 1 20 - - 45

Additions - - - Disposals (1) (30) (1) (52) (3) - (87)

Balance as at March 31, 2023 17 48 65 Exchange fluctuations 1 - 1 6 - 1 9

Accumulated Depreciation Balance as at March 31, 2022 23 150 71 176 13 5 438

Balance as at April 1, 2021 - 10 10 Additions 1 31 2 59 3 2 98

Depreciation for the year - 1 1 Disposals (3) (25) (2) (10) (10) (4) (54)

Balance as at March 31, 2022 - 11 11 Exchange fluctuations 1 5 2 17 - - 25

Depreciation for the year - 2 2 Balance as at March 31, 2023 22 161 73 242 6 3 507

Balance as at March 31, 2023 - 13 13 Accumulated depreciation

Net Block as at March 31, 2022 17 37 54 Balance as at April 1, 2021 3 42 40 103 11 2 201

Net Block as at March 31, 2023 17 35 52 Amortisation for the year 1 28 14 51 4 1 99

Disposals - (25) (1) (52) (3) - (81)

Footnotes: Exchange fluctuations - - - 4 - - 4

a) Disclosures relating to fair valuation of investment property Balance as at March 31, 2022 4 45 53 106 12 3 223

Fair value of the above investment property as at March 31, 2023 is ` 267 crore (2022: ` 266 crore) based on external valuation. Amortisation for the year 1 30 14 58 3 1 107

Disposals (1) (15) - (10) (10) (4) (40)

Fair Value Hierarchy Exchange fluctuations - 3 2 10 - - 15

The fair value of investment property has been determined by external independent registered valuers as defined under rule Balance as at March 31, 2023 4 63 69 164 5 - 305

2 of Companies (Registered Valuers and Valuation) Rules, 2017, having appropriate recognised professional qualification and Net Block as at March 31, 2022 19 105 18 70 1 2 215

recent experience in the location and category of the property being valued. Net Block as at March 31, 2023 18 98 4 78 1 3 202

Footnotes:

The fair value measurement for all of the investment property has been categorised as a level 3 fair value based on the inputs (Refer note 39 for lease liabilities related disclosures)

to the valuation techniques used.

7(a). Goodwill on consolidation

Description of valuation technique used ` in crore

The Group obtains independent valuations of its investment property after every three years. The fair value of the investment Particulars Year ended Year ended

property have been derived using the Direct Comparison Method. The direct comparison approach involves a comparison of March 31, 2023 March 31, 2022

the investment property to similar properties that have actually been sold in arms-length distance from investment property or Carrying value as at April 1 1,971 1,917

are offered for sale in the same region. This approach demonstrates what buyers have historically been willing to pay (and sellers Exchange fluctuations 138 54

willing to accept) for similar properties in an open and competitive market, and is particularly useful in estimating the value of Carrying value as at March 31 2,109 1,971

the land and properties that are typically traded on a unit basis. This approach leads to a reasonable estimation of the prevailing

price. Given that the comparable instances are located in close proximity to the investment property; these instances have been Goodwill of ` 1,719 crore (2022: ` 1,586 crore) and ` 238 crore (2022: ` 233 crore) relates to the CGUs - Tata Chemicals North America

assessed for their locational comparative advantages and disadvantages while arriving at the indicative price assessment for Inc. and it's subsidiaries ('TCNA Group') and Cheshire Salt Holdings Limited Group and it's subsidiaries ('CSHL Group') respectively.

investment property. The estimated value in use of the CGUs are based on future cash flows assuming an terminal annual growth rate of 1% to 3.5% for

the period subsequent to the forecast period of 5 years and discount rates in the range of 5% to 10%, which consider the operating

b) The Group has not earned any material rental income on the above properties. and macro-economic environment in which the entities operate.

An analysis of the sensitivity of the change in key parameters (operating margin, discount rates and long term average growth rate),

based on probable assumptions, did not result in any probable scenario in which the recoverable amount of the CGUs would decrease

below the carrying amount.

Goodwill of ` 152 crore (2022: ` 152 crore) has been allocated to three CGUs (Individually immaterial) within the specialty products,

and evaluated based on their recoverable amounts which exceeds their carrying amounts.

302 303