Page 245 - Tata Chemical Annual Report_2022-2023

P. 245

Integrated Annual Report 2022-23 01-83 84-192 193-365

Integrated Report Statutory Reports Financial Statements

Standalone

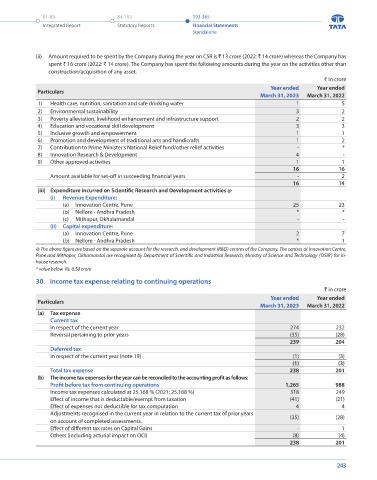

28. Depreciation and amortisation expense (ii) Amount required to be spent by the Company during the year on CSR is ` 13 crore (2022: ` 14 crore) whereas the Company has

` in crore spent ` 16 crore (2022: ` 14 crore). The Company has spent the following amounts during the year on the activities other than

Year ended Year ended construction/acquisition of any asset.

Particulars ` in crore

March 31, 2023 March 31, 2022

(a) Depreciation of property, plant and equipment 238 213 Particulars Year ended Year ended

(b) Depreciation of investment property 1 1 March 31, 2023 March 31, 2022

(c) Amortisation of right-of-use assets 3 4 1) Health care, nutrition, sanitation and safe drinking water 1 5

(d) Amortisation of intangible assets 3 4 2) Environmental sustainability 3 2

245 222 3) Poverty alleviation, livelihood enhancement and infrastructure support 2 2

4) Education and vocational skill development 3 3

29. Other Expenses 5) Inclusive growth and empowerment 1 1

` in crore 6) Promotion and development of traditional arts and handicrafts 1 2

Year ended Year ended 7) Contribution to Prime Minister's National Relief fund/other relief activities - *

Particulars 8) Innovation Research & Development 4 -

March 31, 2023 March 31, 2022 9) Other approved activities 1 1

(a) Stores and spare parts consumed 65 64 16 16

(b) Packing materials consumed 125 125 Amount available for set-off in succeeding financial years - 2

(c) Repairs - Buildings 7 7 16 14

- Machinery 85 67 (iii) Expenditure incurred on Scientific Research and Development activities @

- Others 2 2 (i) Revenue Expenditure:

(d) Rent 9 6 (a) Innovation Centre, Pune 25 23

(e) Royalty, rates and taxes 48 41 (b) Nellore - Andhra Pradesh * *

(f) Foreign exchange loss (net) 3 - (c) Mithapur, Okhalamandal - -

(g) Distributors' service charges 2 2 (ii) Capital expenditure: 2 7

(a) Innovation Centre, Pune

(h) Sales promotion expenses 3 4 (b) Nellore - Andhra Pradesh * 1

(i) Insurance charges 18 17 @ The above figure are based on the separate account for the research, and development (R&D) centres of the Company. The centres at Innovation Centre,

(j) Loss on assets sold, discarded or written off (net) 5 4 Pune and Mithapur, Okhamandal are recognised by Department of Scientific and Industrial Research, Ministry of Science and Technology ('DSIR') for in-

(k) Bad debts and other receivables written off 818 7 house research.

(l) Provision for doubtful debts, advances and other receivables (net) (819) (6) * value below Rs. 0.50 crore

(m) Directors' fees and commission 3 3

(n) Auditors' remuneration (footnote 'i') 2 3 30. Income tax expense relating to continuing operations

(o) Expenditure towards Corporate Social Responsibility (CSR) (footnote 'ii') 16 14 ` in crore

(p) Others 153 100 Particulars Year ended Year ended

545 460 March 31, 2023 March 31, 2022

(a) Tax expense

Footnotes: Current tax

274

232

` in crore In respect of the current year (35) (28)

Reversal pertaining to prior years

Year ended Year ended

Particulars 239 204

March 31, 2023 March 31, 2022 Deferred tax

(i) Auditors' remuneration In respect of the current year (note 19) (1) (3)

Statutory Auditors (1) (3)

(a) For services as auditor 2 2 Total tax expense 238 201

(b) For other services (including certification) * 1 (b) The income tax expenses for the year can be reconciled to the accounting profit as follows:

(c) for reimbursement of expenses * * Profit before tax from continuing operations 1,265 988

Cost Auditors Income tax expenses calculated at 25.168 % (2021: 25.168 %) 318 249

(a) For services as auditor * * Effect of income that is deductable/exempt from taxation (41) (21)

Effect of expenses not deductible for tax computation

4

4

2 3

Adjustments recognised in the current year in relation to the current tax of prior years

* value below ` 0.50 crore on account of completed assessments. (35) (28)

Effect of different tax rates on Capital Gains - 1

Others (including acturial impact on OCI) (8) (4)

238 201

242 243