Page 240 - Tata Chemical Annual Report_2022-2023

P. 240

Integrated Annual Report 2022-23 01-83 84-192 193-365

Integrated Report Statutory Reports Financial Statements

Standalone

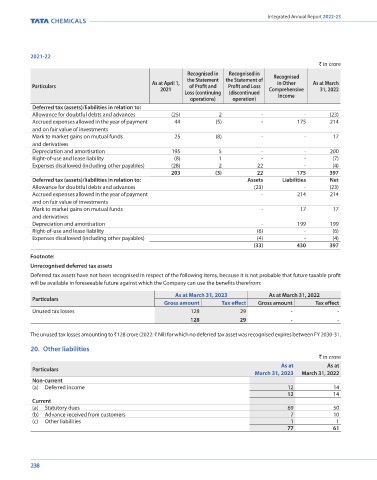

2021-22 21. Trade payables

` in crore ` in crore

Recognised in Recognised in Recognised As at As at

the Statement the Statement of Particulars March 31, 2023 March 31, 2022

As at April 1, in Other As at March

Particulars of Profit and Profit and Loss

2021 Comprehensive 31, 2022 (a) Trade payables (footnote 'i') 482 554

Loss (continuing (discontinued Income

operations) operation) (b) Acceptances (footnote 'ii') 213 -

Deferred tax (assets)/liabilities in relation to: (c) Amount due to micro enterprises and small enterprises (footnote 'iii') 3 6

Allowance for doubtful debts and advances (25) 2 - - (23) 698 560

Accrued expenses allowed in the year of payment 44 (5) - 175 214 Footnotes:

and on fair value of investments (i) Trade payables are non-interest bearing and are normally settled within 60 days.

Mark to market gains on mutual funds 25 (8) - - 17

and derivatives (ii) Acceptances includes credit availed by the suppliers from banks for goods supplied to the Company. The arrangements are

Depreciation and amortisation 195 5 - - 200 interest bearing, where the Company bears the interest cost and are payable within one year.

Right-of-use and lease liability (8) 1 - - (7) (iii) According to information available with the Management, on the basis of intimation received from suppliers regarding their

Expenses disallowed (including other payables) (28) 2 22 - (4) status under the Micro, Small and Medium Enterprises Development Act, 2006 ('MSMED Act'), the Company has amounts due

203 (3) 22 175 397 to Micro, Small and Medium Enterprises under the said Act as follows :

Deferred tax (assets)/liabilities in relation to: Assets Liabilities Net ` in crore

Allowance for doubtful debts and advances (23) - (23) Year ended Year ended

Accrued expenses allowed in the year of payment - 214 214 Particulars March 31, 2023 March 31, 2022

and on fair value of investments 1. (a) Principal overdue amount remaining unpaid to any supplier * *

Mark to market gains on mutual funds - 17 17 (b) Interest on 1(a) above * *

and derivatives 2. (a) The amount of principal paid beyond the appointed date 3 20

Depreciation and amortisation - 199 199 (b) The amount of interest paid beyond the appointed date - -

Right-of-use and lease liability (6) - (6)

Expenses disallowed (including other payables) (4) - (4) 3. Amount of interest due and payable on delayed payments * *

(33) 430 397 4. Amount of interest accrued and remaining unpaid as at year end * *

5. The amount of further interest due and payable even in the succeeding year - -

Footnote: * value below ` 0.50 crore

Unrecognised deferred tax assets

Deferred tax assets have not been recognised in respect of the following items, because it is not probable that future taxable profit Trade Payables Ageing Schedule

will be available in foreseeable future against which the Company can use the benefits therefrom: As on March 31, 2023

As at March 31, 2023 As at March 31, 2022 ` in crore

Particulars

Gross amount Tax effect Gross amount Tax effect Outstanding for following period from due date of payment Total

Unused tax losses 128 29 - - Particulars Unbilled Not Due Less than 1-2 2-3 More than

128 29 - - 1 year years years 3 years

(i) MSME - 1 2 - - - 3

The unused tax losses amounting to `128 crore (2022: ` Nil) for which no deferred tax asset was recognised expires between FY 2030-31. (ii) Others 86 567 30 8 4 - 695

(iii) Disputed dues - MSME - - - - - - -

20. Other liabilities (iv) Disputed dues - Others - - - - - - -

` in crore Total 86 568 32 8 4 - 698

As at As at

Particulars As on March 31, 2022

March 31, 2023 March 31, 2022 ` in crore

Non-current

(a) Deferred income 12 14 Outstanding for following period from due date of payment Total

12 14 Particulars Unbilled Not Due Less than 1-2 2-3 More than

Current 6 months years years 3 years

(a) Statutory dues 69 50 (i) MSME - 5 1 - - - 6

(b) Advance received from customers 7 10 (ii) Others 104 234 209 5 1 - 553

(c) Other liabilities 1 1 (iii) Disputed dues - MSME - - - - - - -

77 61

(iv) Disputed dues - Others - - - - - 1 1

Total 104 239 210 5 1 1 560

238 239