Page 243 - Tata Chemical Annual Report_2022-2023

P. 243

Integrated Annual Report 2022-23 01-83 84-192 193-365

Integrated Report Statutory Reports Financial Statements

Standalone

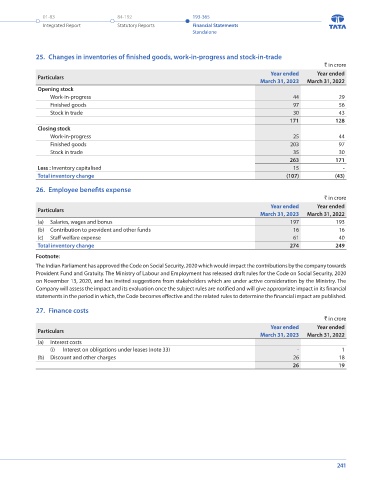

22. Tax assets 25. Changes in inventories of finished goods, work-in-progress and stock-in-trade

` in crore ` in crore

As at As at Year ended Year ended

Particulars Particulars

March 31, 2023 March 31, 2022 March 31, 2023 March 31, 2022

(a) Tax assets Opening stock

Non-current - Advance tax assets (net) 667 613 Work-in-progress 44 29

(b) Current tax liabilities (net) 91 107 Finished goods 97 56

Stock in trade 30 43

23. Revenue from operations 171 128

` in crore Closing stock

Year ended Year ended Work-in-progress 25 44

Particulars

March 31, 2023 March 31, 2022 Finished goods 203 97

(a) Sales of products (footnote 'i' and 'ii') 4,915 3,707 Stock in trade 35 30

(b) Other operating revenues 263 171

(i) Sale of scrap and others 15 14

4,930 3,721 Less : Inventory capitalised 15 -

Footnotes: Total inventory change (107) (43)

(i) Reconciliation of sales of products

Revenue from contracts with customer 4,988 3,809 26. Employee benefits expense

Adjustments made to contract price on account of ` in crore

(a) Discounts / rebates / incentives (73) (102) Year ended Year ended

4,915 3,707 Particulars March 31, 2023 March 31, 2022

(ii) For operating segments revenue, geographical segments revenue, revenue from major products and revenue from major (a) Salaries, wages and bonus 197 193

customers (note 35.1). (b) Contribution to provident and other funds 16 16

(c) Staff welfare expense 61 40

24. Other income Total inventory change 274 249

` in crore

Year ended Year ended Footnote:

Particulars The Indian Parliament has approved the Code on Social Security, 2020 which would impact the contributions by the company towards

March 31, 2023 March 31, 2022

(a) Dividend income from Provident Fund and Gratuity. The Ministry of Labour and Employment has released draft rules for the Code on Social Security, 2020

(i) Non-current investments in on November 13, 2020, and has invited suggestions from stakeholders which are under active consideration by the Ministry. The

- Subsidiaries (measured at cost) 29 29 Company will assess the impact and its evaluation once the subject rules are notified and will give appropriate impact in its financial

- Joint venture (measured at cost) 92 28 statements in the period in which, the Code becomes effective and the related rules to determine the financial impact are published.

- Other non-current investments (measured at FVTOCI) 41 26

162 83 27. Finance costs

(b) Interest (finance income) ` in crore

(i) On bank deposits (financial assets at amortised cost) 18 19

(ii) Other interest (financial assets at FVTPL) 15 15 Particulars Year ended Year ended

33 34 March 31, 2023 March 31, 2022

(c) Interest on refund of taxes 28 76 (a) Interest costs

(d) Others (i) Interest on obligations under leases (note 33) - 1

(i) Corporate guarantee commission 3 5 (b) Discount and other charges 26 18

(ii) Gain on sale/redemption of investments (net) 54 46 26 19

(iii) Foreign exchange gain (net) - 5

(iv) Miscellaneous income (footnote 'i') 21 29

78 85

301 278

Footnote:

(i) Miscellaneous income primarily includes rent income and liabilities written back.

240 241