Page 246 - Tata Chemical Annual Report_2022-2023

P. 246

Integrated Annual Report 2022-23 01-83 84-192 193-365

Integrated Report Statutory Reports Financial Statements

Standalone

31. Discontinued operations (b) The Company makes annual contributions to the Tata Chemicals Employees' Gratuity Trust and to the Employees' Group Gratuity-

cum-Life Assurance Scheme of the Life Insurance Corporation of India, for funding the defined benefit plans for qualifying

Exceptional gain from discontinued operations for the year ended March 31, 2022 is in respect of subsidy for previous years

pertaining to the erstwhile fertilizer business, which is received in the current period from the transferor pursuant to the Business employees. The scheme provides for lump sum payment to vested employees at retirement or death while in employment

transfer agreement. or on termination of employment. Employees, upon completion of the vesting period, are entitled to a benefit equivalent to

either half month, three fourth month and full month salary last drawn for each completed year of service depending upon the

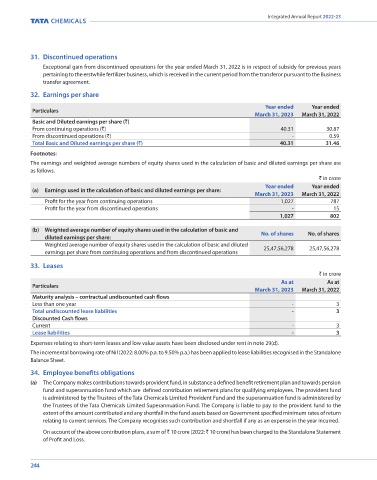

32. Earnings per share completed years of continuous service in case of retirement or death while in employment. In case of termination, the benefit

is equivalent to fifteen days salary last drawn for each completed year of service in line with the Payment of Gratuity Act, 1972.

Year ended Year ended

Particulars Vesting occurs upon completion of five years of continuous service.

March 31, 2023 March 31, 2022

Basic and Diluted earnings per share (`) The trustees of the trust fund are responsible for the overall governance of the plan and to act in accordance with the provisions

From continuing operations (`) 40.31 30.87 of the trust deed and rules in the best interests of the plan participants. They are tasked with periodic reviews of the solvency

From discontinued operations (`) - 0.59 of the fund and play a role in the long-term investment, risk management and funding strategy.

Total Basic and Diluted earnings per share (`) 40.31 31.46

The Company also provides post retirement medical benefits to eligible employees under which employees at Mithapur who

Footnotes: have retired from service of the Company are entitled for free medical facility at the Company hospital during their lifetime.

The earnings and weighted average numbers of equity shares used in the calculation of basic and diluted earnings per share are Other employees are entitled to domiciliary treatment exceeding the entitled limits for the treatments covered under the

as follows. Health Insurance Scheme upto slabs defined in the scheme. The floater mediclaim policy also covers retired employees based

` in crore on eligibility, for such benefit.

Year ended Year ended

(a) Earnings used in the calculation of basic and diluted earnings per share: The Company provides pension, housing / house rent allowance and medical benefits to retired Managing and Executive

March 31, 2023 March 31, 2022 Directors who have completed ten years of continuous service in Tata Group and three years of continuous service as Managing

Profit for the year from continuing operations 1,027 787 Director/Executive Director or five years of continuous service as Managing Director/Executive Director. The directors are entitled

Profit for the year from discontinued operations - 15 upto seventy five percent of last drawn salary for life and on death 50% of the pension is payable to the spouse for the rest of

1,027 802

his/her life.

(b) Weighted average number of equity shares used in the calculation of basic and No. of shares No. of shares Family benefit scheme is applicable to all permanent employees in management, officers and workmen who have completed

diluted earnings per share: one year of continuous service. In case of untimely death of the employee, nominated beneficiary is entitled to an amount equal

Weighted average number of equity shares used in the calculation of basic and diluted 25,47,56,278 25,47,56,278 to the last drawn salary (Basic Salary, DA and FDA) till the normal retirement date of the deceased employee.

earnings per share from continuing operations and from discontinued operations

The most recent actuarial valuations of plan assets and the present values of the defined benefit obligations were carried out at

33. Leases March 31, 2023. The present value of the defined benefit obligations and the related current service cost and past service cost,

` in crore were measured using the Projected Unit Credit Method.

As at As at

Particulars The following tables set out the funded status and amounts recognised in the Company's Standalone Financial Statements as

March 31, 2023 March 31, 2022 at March 31, 2023 for the Defined Benefit Plans.

Maturity analysis – contractual undiscounted cash flows

Less than one year - 3 1. Changes in the defined benefit obligation:

Total undiscounted lease liabilities - 3 ` in crore

Discounted Cash flows As at March 31, 2023 As at March 31, 2022

Current - 3

Post

Post

Lease liabilities - 3 Particulars retirement Directors' Family retirement Directors' Family

retirement benefit

benefit Gratuity

retirement

Expenses relating to short-term leases and low value assets have been disclosed under rent in note 29(d). Gratuity medical obligations scheme medical obligations scheme

benefits benefits

The incremental borrowing rate of Nil (2022: 8.00% p.a. to 9.50% p.a.) has been applied to lease liabilities recognised in the Standalone

Balance Sheet. At the beginning of the year 88 71 52 11 92 80 53 11

Current service cost 4 2 1 1 4 2 1 1

34. Employee benefits obligations Past service cost - - 13 - - - - -

(a) The Company makes contributions towards provident fund, in substance a defined benefit retirement plan and towards pension Interest cost 6 5 4 1 5 5 3 1

fund and superannuation fund which are defined contribution retirement plans for qualifying employees. The provident fund Remeasurement (gain)/loss

is administered by the Trustees of the Tata Chemicals Limited Provident Fund and the superannuation fund is administered by Actuarial (gain) / loss arising from:

the Trustees of the Tata Chemicals Limited Superannuation Fund. The Company is liable to pay to the provident fund to the - Change in financial assumptions (2) (4) (3) - (3) (6) (3) -

extent of the amount contributed and any shortfall in the fund assets based on Government specified minimum rates of return

relating to current services. The Company recognises such contribution and shortfall if any as an expense in the year incurred. - Experience adjustments 1 (8) 2 (1) - (8) 1 -

Benefits paid (11) (2) (3) (1) (10) (2) (3) (2)

On account of the above contribution plans, a sum of ` 10 crore (2022: ` 10 crore) has been charged to the Standalone Statement At the end of the year 86 64 66 11 88 71 52 11

of Profit and Loss.

244 245