Page 239 - Tata Chemical Annual Report_2022-2023

P. 239

Integrated Annual Report 2022-23 01-83 84-192 193-365

Integrated Report Statutory Reports Financial Statements

Standalone

17. Other financial liabilities Asset Provision for

` in crore Particulars retirement litigations Total

As at As at obligation (1) and others (2)

Particulars

March 31, 2023 March 31, 2022 Balance as at March 31, 2022

Non-Current Non-Current 2 - 2

(a) Security deposit from customers 2 - Current 13 155 168

2 - Total 15 155 170

Current Balance as at March 31, 2023

(a) Interest accrued 4 - Non-Current 2 - 2

(b) Creditors for capital goods 155 94

(c) Unclaimed dividend (footnote 'i') 18 18 Current 13 177 190

(d) Derivatives (note 36) 5 4 Total 15 177 192

(e) Security deposit from customers 24 22 Nature of provisions:

(f) Accrued expenses 42 42 1) Provision for asset retirement obligation includes provision towards site restoration expense and decomissioning charges. The

(g) Others 6 1 timing of the outflows is expected to be within a period of one to thirty years from the date of balance sheet.

254 181

2) Provision for litigations and others represents management's best estimate of outflow of economic resources in respect of water

Footnote: charges, entry tax, land revenue and other disputed items including direct taxes, indirect taxes and other claims. The timing of

(i) There has been no delay in transferring amounts, required to be transferred, to the Investor Education and Protection Fund by outflows is uncertain and will depend on the cessation of the respective cases

the Company except for ` 1 crore (2022: ` 1 crore), wherein legal disputes with regards to ownership have remained unresolved.

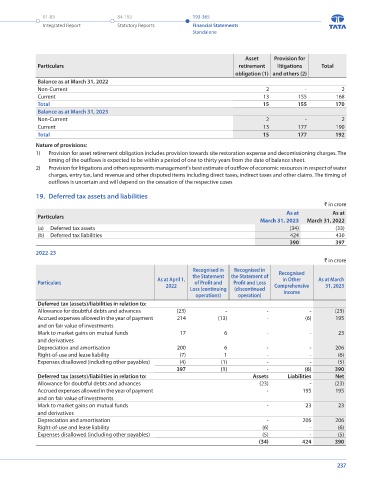

19. Deferred tax assets and liabilities

18. Provisions ` in crore

` in crore Particulars As at As at

As at As at March 31, 2023 March 31, 2022

Particulars

March 31, 2023 March 31, 2022 (a) Deferred tax assets (34) (33)

Non-Current (b) Deferred tax liabilities 424 430

(a) Provision for employee benefits 390 397

(i) Pension and other post retirement benefits (note 34 (2)) 135 129 2022-23

(ii) Long service awards 2 2 ` in crore

137 131

(b) Other provisions (footnote 'i') 2 2 Recognised in Recognised in Recognised

139 133 As at April 1, the Statement the Statement of in Other As at March

Current Particulars 2022 of Profit and Profit and Loss Comprehensive 31, 2023

(a) Provision for employee benefits Loss (continuing (discontinued Income

(i) Pension and other post retirement benefits (note 34 (2)) 7 6 operations) operation)

(ii) Compensated absences and long service awards 36 45 Deferred tax (assets)/liabilities in relation to:

43 51 Allowance for doubtful debts and advances (23) - - - (23)

(b) Other provisions (footnote 'i') 190 168 Accrued expenses allowed in the year of payment 214 (13) - (6) 195

233 219 and on fair value of investments

Footnotes: Mark to market gains on mutual funds 17 6 - - 23

i) Other provisions include: ` in crore and derivatives

Depreciation and amortisation

Asset Provision for Right-of-use and lease liability 200 6 - - 206

(6)

(7)

1

-

-

Particulars retirement litigations Total Expenses disallowed (including other payables) (4) (1) - - (5)

obligation (1) and others (2) 397 (1) - (6) 390

Balance as at March 31, 2021 15 141 156 Deferred tax (assets)/liabilities in relation to: Assets Liabilities Net

Provisions pertaining to discontinued operation (Phosphatic Fertilisers business) - 8 8 Allowance for doubtful debts and advances (23) - (23)

Provisions recognised during the year - 7 7 Accrued expenses allowed in the year of payment - 195 195

Payments / utilisation during the year - (1) (1) and on fair value of investments

Balance as at March 31, 2022 15 155 170 Mark to market gains on mutual funds - 23 23

Provisions pertaining to discontinued operation (Phosphatic Fertilisers business) - 8 8 and derivatives - 206 206

Depreciation and amortisation

Provisions recognised during the year - 15 15 Right-of-use and lease liability (6) - (6)

Payments/utilisation during the year - (1) (1) Expenses disallowed (including other payables) (5) - (5)

Balance as at March 31, 2023 15 177 192 (34) 424 390

236 237