Page 237 - Tata Chemical Annual Report_2022-2023

P. 237

Integrated Annual Report 2022-23 01-83 84-192 193-365

Integrated Report Statutory Reports Financial Statements

Standalone

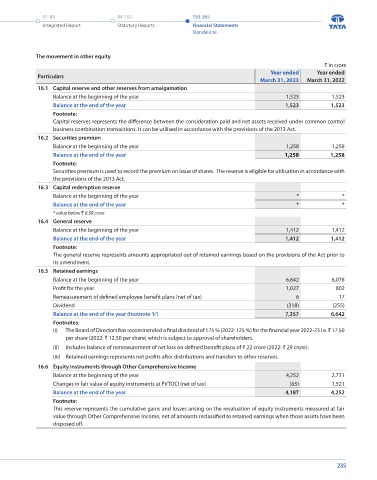

(ii) Terms/ rights attached to equity shares The movement in other equity

The Company has issued one class of ordinary shares at par value of ` 10 per share. Each shareholder is eligible for one vote per ` in crore

share held. The dividend proposed by the Board of Directors is subject to the approval of the shareholders in the ensuing Annual Particulars Year ended Year ended

General Meeting except in the case of interim dividend. In the event of liquidation, the equity shareholders are eligible to receive March 31, 2023 March 31, 2022

the remaining assets of the Company, after distribution of all preferential accounts, in proportion to their shareholding. 16.1 Capital reserve and other reserves from amalgamation

Balance at the beginning of the year 1,523 1,523

(iii) Details of shares held by each shareholder holding more than 5% shares. Balance at the end of the year 1,523 1,523

As at March 31, 2023 As at March 31, 2022 Footnote:

Particulars Capital reserves represents the difference between the consideration paid and net assets received under common control

No of shares % No of shares %

Ordinary shares with voting rights business combination transactions. It can be utilised in accordance with the provisions of the 2013 Act.

(i) Tata Sons Private Limited 8,12,60,095 31.90 8,12,60,095 31.90 16.2 Securities premium

(ii) Life Insurance Corporation Of India * * 1,86,10,802 6.83 Balance at the beginning of the year 1,258 1,258

(iii) Tata Investment Corporation Limited 1,52,00,001 5.97 1,52,00,001 5.97 Balance at the end of the year 1,258 1,258

* Not holding more than 5% shares Footnote:

Securities premium is used to record the premium on issue of shares. The reserve is eligible for utilisation in accordance with

(iv) Disclosures of Shareholding of Promoters - Shares held by the Promoters: the provisions of the 2013 Act.

16.3 Capital redemption reserve

As at March 31, 2023 As at March 31, 2022 Change

Particulars Balance at the beginning of the year * *

No of shares % No of shares % %

Ordinary shares with voting rights Balance at the end of the year * *

Promoter * value below ` 0.50 crore

(i) Tata Sons Private Limited 8,12,60,095 31.90 8,12,60,095 31.90 - 16.4 General reserve

Promoter Group Balance at the beginning of the year 1,412 1,412

(i) Tata Investment Corporation Limited 1,52,00,001 5.97 1,52,00,001 5.97 - Balance at the end of the year 1,412 1,412

(ii) Voltas Limited 2,00,440 0.08 2,00,440 0.08 - Footnote:

The general reserve represents amounts appropriated out of retained earnings based on the provisions of the Act prior to

(iii) Tata Industries Limited 77,647 0.03 77,647 0.03 - its amendment.

(iv) Tata Motors Finance Limited 10,060 0.00 10,060 0.00 - 16.5 Retained earnings

(v) Titan Company Limited 560 0.00 560 0.00 - Balance at the beginning of the year 6,642 6,078

(vi) Tata Coffee Limited 150 0.00 150 0.00 -

Profit for the year 1,027 802

16. Other equity Remeasurement of defined employee benefit plans (net of tax) 6 17

` in crore Dividend (318) (255)

As at As at Balance at the end of the year (footnote 'ii') 7,357 6,642

Particulars

March 31, 2023 March 31, 2022 Footnotes:

1 Capital reserve and other reserves from amalgamation 1,523 1,523 (i) The Board of Directors has recommended a final dividend of 175 % (2022: 125 %) for the financial year 2022-23 i.e. ` 17.50

2 Securities premium 1,258 1,258 per share (2022: ` 12.50 per share) which is subject to approval of shareholders.

3 Capital redemption reserve * * (ii) Includes balance of remeasurement of net loss on defined benefit plans of ` 22 crore (2022: ` 29 crore).

4 General reserve 1,412 1,412 (iii) Retained earnings represents net profits after distributions and transfers to other reserves.

5 Retained earnings 7,357 6,642 16.6 Equity instruments through Other Comprehensive Income

6 Equity instruments through Other Comprehensive Income 4,187 4,252 Balance at the beginning of the year 4,252 2,731

Total other equity 15,737 15,087 Changes in fair value of equity instruments at FVTOCI (net of tax) (65) 1,521

* value below ` 0.50 crore Balance at the end of the year 4,187 4,252

Footnote:

This reserve represents the cumulative gains and losses arising on the revaluation of equity instruments measured at fair

value through Other Comprehensive Income, net of amounts reclassified to retained earnings when those assets have been

disposed off.

234 235