Page 235 - Tata Chemical Annual Report_2022-2023

P. 235

Integrated Annual Report 2022-23 01-83 84-192 193-365

Integrated Report Statutory Reports Financial Statements

Standalone

(iii) Trade receivables have been offered as security against the working capital facilities provided by the bank.

Trade Receivable ageing schedule:

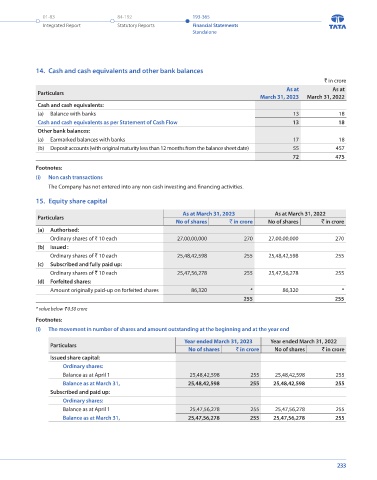

14. Cash and cash equivalents and other bank balances

As on March 31, 2023 ` in crore

` in crore

As at

As at

Outstanding for following period from due date of payment Particulars March 31, 2023 March 31, 2022

More

Particulars Less than 6 months 1-2 2-3 Cash and cash equivalents:

Unbilled Not Due than Total

6 months - 1 year years years (a) Balance with banks 13 18

3 years

(i) Undisputed Trade Receivables - 10 148 40 2 1 - - 201 Cash and cash equivalents as per Statement of Cash Flow 13 18

Considered good Other bank balances:

(ii) Undisputed Trade Receivables - which - - - - - - - - (a) Earmarked balances with banks 17 18

have significant increase in credit risk (b) Deposit accounts (with original maturity less than 12 months from the balance sheet date) 55 457

(iii) Undisputed Trade Receivables - - - 1 - - - 13 14 72 475

Credit Impaired

(iv) Disputed Trade Receivables - - - - - - - - - Footnotes:

Considered Good (i) Non cash transactions

(v) Disputed Trade Receivables - which - - - - - - - - The Company has not entered into any non cash investing and financing activities.

have significant increase in credit risk

(vi) Disputed Trade Receivables - - - - - - - 39 39 15. Equity share capital

Credit Impaired

Total 10 148 41 2 1 - 52 254 Particulars As at March 31, 2023 As at March 31, 2022

Less: Impairment loss allowance (53) No of shares ` in crore No of shares ` in crore

201 (a) Authorised:

Ordinary shares of ` 10 each 27,00,00,000 270 27,00,00,000 270

As on March 31, 2022 (b) Issued :

` in crore Ordinary shares of ` 10 each 25,48,42,598 255 25,48,42,598 255

Outstanding for following period from due date of payment (c) Subscribed and fully paid up:

More

Particulars Less than 6 months 1-2 2-3 Ordinary shares of ` 10 each 25,47,56,278 255 25,47,56,278 255

Unbilled Not Due than Total

6 months - 1 year years years (d) Forfeited shares:

3 years

(i) Undisputed Trade Receivables - 8 154 18 - 1 - 1 182 Amount originally paid-up on forfeited shares 86,320 * 86,320 *

Considered good 255 255

(ii) Undisputed Trade Receivables - which - - - - - - - - * value below ` 0.50 crore

have significant increase in credit risk

(iii) Undisputed Trade Receivables - - - 1 - - - 11 12 Footnotes:

Credit Impaired (i) The movement in number of shares and amount outstanding at the beginning and at the year end

(iv) Disputed Trade Receivables - - - - - - - - - Year ended March 31, 2023 Year ended March 31, 2022

Considered Good Particulars No of shares ` in crore No of shares ` in crore

(v) Disputed Trade Receivables - which - - - - - - - - Issued share capital:

have significant increase in credit risk Ordinary shares:

(vi) Disputed Trade Receivables - - - - - - - 40 40

Credit Impaired Balance as at April 1 25,48,42,598 255 25,48,42,598 255

Total 8 154 19 - 1 - 52 234 Balance as at March 31, 25,48,42,598 255 25,48,42,598 255

Less: Impairment loss allowance (52) Subscribed and paid up:

182 Ordinary shares:

Balance as at April 1 25,47,56,278 255 25,47,56,278 255

Balance as at March 31, 25,47,56,278 255 25,47,56,278 255

232 233