Page 231 - Tata Chemical Annual Report_2022-2023

P. 231

Integrated Annual Report 2022-23 01-83 84-192 193-365

Integrated Report Statutory Reports Financial Statements

Standalone

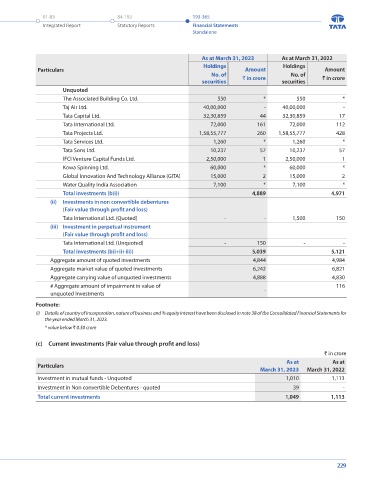

7(b). Goodwill As at March 31, 2023 As at March 31, 2022

Goodwill of ` 46 crore (2022: ` 46 crore) relates to the precipitated silica business. The estimated value in use of the CGU is based on Particulars Holdings Amount Holdings Amount

future cash flows of forecasted period of 20 years and discount rate of 11.8%, which consider the operating and macro-economic No. of ` in crore No. of ` in crore

environment in which the entity operates. securities securities

Unquoted

An analysis of the sensitivity of the change in key parameters (operating margin, discount rates and long term average growth rate),

based on reasonably probable assumptions, did not result in any probable scenario in which the recoverable amount of the CGU The Associated Building Co. Ltd. 550 * 550 *

would decrease below the carrying amount. Taj Air Ltd. 40,00,000 - 40,00,000 -

Tata Capital Ltd. 32,30,859 44 32,30,859 17

8. Investments (note 42(e)) Tata International Ltd. 72,000 161 72,000 112

As at March 31, 2023 As at March 31, 2022 Tata Projects Ltd. 1,58,55,777 260 1,58,55,777 428

Holdings Holdings Tata Services Ltd. 1,260 * 1,260 *

Particulars Amount Amount

No. of ` in crore No. of ` in crore Tata Sons Ltd. 10,237 57 10,237 57

securities securities IFCI Venture Capital Funds Ltd. 2,50,000 1 2,50,000 1

(a) Investments in equity instruments in subsidiaries and Kowa Spinning Ltd. 60,000 * 60,000 *

joint ventures (fully paid up) (footnote "i") Global Innovation And Technology Alliance (GITA) 15,000 2 15,000 2

(i) Subsidiaries (at cost) Water Quality India Association 7,100 * 7,100 *

Quoted Total investments (b(i)) 4,889 4,971

Rallis India Ltd. 9,73,41,610 480 9,73,41,610 480 (ii) Investments in non convertible debentures

Unquoted (Fair value through profit and loss)

Tata Chemicals International Pte. Limited 48,53,07,852 3,124 48,53,07,852 3,124 Tata International Ltd. (Quoted) - - 1,500 150

Ncourage Social Enterprise Foundation 25,50,000 3 25,50,000 3 (iii) Investment in perpetual instrument

(ii) Investments in preference shares (fully paid up) (Fair value through profit and loss)

Unquoted (at cost) Tata International Ltd. (Unquoted) - 150 - -

Direct Subsidiary Total investments (b(i+ii+iii)) 5,039 5,121

Non Cumulative Redeemable Preference Shares of 1,61,00,000 750 1,61,00,000 750 Aggregate amount of quoted investments 4,844 4,984

Tata Chemicals International Pte. Limited

Indirect Subsidiaries Aggregate market value of quoted investments 6,242 6,821

Non Cumulative Redeemable Preference Shares of Aggregate carrying value of unquoted investments 4,888 4,830

Gusiute Holdings (UK) Limited # Aggregate amount of impairment in value of - 116

Non Cumulative Redeemable Preference Shares of - - 1,78,50,000 116 unquoted Investments

Homefield Pvt UK Limited (note 39 (b)) Footnote:

Less: Impairment # - (116) (i) Details of country of incorporation, nature of business and % equity interest have been disclosed in note 38 of the Consolidated Financial Statements for

(iii) Joint ventures (at cost) the year ended March 31, 2023.

Unquoted * value below ` 0.50 crore

Indo Maroc Phosphore, S.A. , Morocco 2,06,666 166 2,06,666 166

Tata Industries Ltd. 98,61,303 170 98,61,303 170 (c) Current investments (Fair value through profit and loss)

Total investments (i+ii+iii) 4,693 4,693 ` in crore

(b) Other investments Particulars As at As at

(i) Investments in equity instruments March 31, 2023 March 31, 2022

(Fair value through Other Comprehensive Income) Investment in mutual funds - Unquoted 1,010 1,113

Quoted Investment in Non convertible Debentures - quoted 39 -

The Indian Hotels Co. Ltd. 1,18,77,053 385 1,18,77,053 283 Total current investments 1,049 1,113

Oriental Hotels Ltd. 25,23,000 20 25,23,000 16

Tata Investment Corporation Ltd. 4,41,015 77 4,41,015 60

Tata Steel Ltd. 3,09,00,510 323 3,09,00,510 404

Tata Motors Ltd. 19,66,294 83 19,66,294 85

Titan Company Ltd. 1,38,26,180 3,476 1,38,26,180 3,506

228 229