Page 232 - Tata Chemical Annual Report_2022-2023

P. 232

Integrated Annual Report 2022-23 01-83 84-192 193-365

Integrated Report Statutory Reports Financial Statements

Standalone

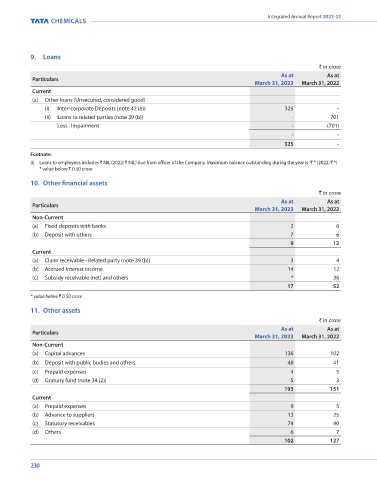

9. Loans

` in crore 12. Inventories

As at As at

Particulars ` in crore

March 31, 2023 March 31, 2022

Current Particulars As at As at

(a) Other loans (Unsecured, considered good) March 31, 2023 March 31, 2022

(i) Inter-corporate Deposits (note 42 (e)) 325 - (a) Raw materials (footnote ‘i’) 868 635

(ii) Loans to related parties (note 39 (b)) - 701 (b) Work-in-progress 25 44

Less : Impairment - (701) (c) Finished goods 203 97

- - (d) Stock in trade (footnote ‘i’) 35 30

(e) Stores, spare parts and packing materials (net) (footnote ‘i’) 72 74

325 -

1,203 880

Footnote: Footnotes:

(i) Loans to employees includes ` NIL (2022: ` NIL) due from officer of the Company. Maximum balance outstanding during the year is ` * (2022: ` *)

* value below ` 0.50 crore (i) Inventories includes goods in transit:

- Raw materials 8 -

10. Other financial assets - Stock in trade 10 7

` in crore - Stores and spare parts and packing materials - 1

As at As at

Particulars (ii) The cost of inventories recognised as an expense includes ` 11 crore (2022: ` 8 crore) in respect of write-down of inventories to

March 31, 2023 March 31, 2022 net realisable value.

Non-Current (iii) Inventories have been offered as security against the working capital facilities provided by the bank (note 42 (c)).

(a) Fixed deposits with banks 2 6

(b) Deposit with others 7 6 13. Trade receivables

9 12 ` in crore

Current Particulars As at As at

(a) Claim receivable - Related party (note 39 (b)) 3 4 March 31, 2023 March 31, 2022

(b) Accrued interest income 14 12 (a) Secured, considered good 12 14

(c) Subsidy receivable (net) and others * 36 (b) Unsecured, considered good 189 168

17 52 (c) Unsecured, credit impaired 53 52

* value below ` 0.50 crore 254 234

Less: Impairment loss allowance (53) (52)

11. Other assets 201 182

` in crore Footnotes:

As at As at

Particulars (i) The Company has appropriate levels of control procedures for new customers which ensures the potential customer's credit

March 31, 2023 March 31, 2022 quality. Credit limits attributed to customers are reviewed periodically by the Management.

Non-Current

(a) Capital advances 136 102 (ii) Movement in Credit impaired

` in crore

(b) Deposit with public bodies and others 48 41 Year ended Year ended

(c) Prepaid expenses 4 5 Particulars March 31, 2023 March 31, 2022

(d) Gratuity fund (note 34 (2)) 5 3 Balance at the beginning of the year 52 57

193 151 Provision during the year 2 1

Current Reversal during the year (1) (6)

(a) Prepaid expenses 9 5

(b) Advance to suppliers 13 25 Balance at the end of the year 53 52

(c) Statutory receivables 74 90

(d) Others 6 7

102 127

230 231