Page 174 - Tata Chemical Annual Report_2022-2023

P. 174

Integrated Annual Report 2022-23 01-83 84-192 193-365

Integrated Report Statutory Reports Financial Statements

Corporate Governance Report

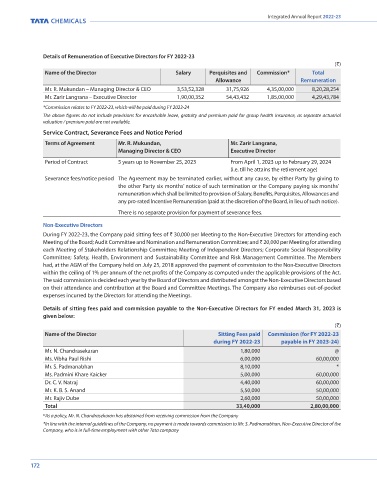

Details of Remuneration of Executive Directors for FY 2022-23 As per the practice, commission to the Directors is paid after the annual accounts are adopted by the Members at the AGM.

(`) The Company has not granted any stock options to its Directors.

Name of the Director Salary Perquisites and Commission* Total Details of Remuneration to Key Managerial Personnel other than Managing Director / Manager / Whole Time Director for

Allowance Remuneration FY 2022-23

Mr. R. Mukundan – Managing Director & CEO 3,53,52,328 31,75,926 4,35,00,000 8,20,28,254 (`)

Mr. Zarir Langrana – Executive Director 1,90,00,352 54,43,432 1,85,00,000 4,29,43,784 Name of Key Managerial Personnel Gross Salary Commission Others Total Remuneration

*Commission relates to FY 2022-23, which will be paid during FY 2023-24 Mr. Nandakumar S. Tirumalai - Chief Financial Officer 2,79,86,130 - 12,61,065 2,92,47,195

The above figures do not include provisions for encashable leave, gratuity and premium paid for group health insurance, as separate actuarial Mr. Rajiv Chandan - Chief General Counsel & Company Secretary 1,90,96,503 - 24,18,789 2,15,15,292

valuation / premium paid are not available.

Service Contract, Severance Fees and Notice Period Succession Plan • Ensuring timely receipt of dividend warrants/annual

Terms of Agreement Mr. R. Mukundan, Mr. Zarir Langrana, The Company believes that sound succession plans for the reports/statutory notices by the shareholders of

the Company.

Managing Director & CEO Executive Director senior leadership are very important for creating a robust

future for the Company. The NRC works along with the

Period of Contract 5 years up to November 25, 2023 From April 1, 2023 up to February 29, 2024 Human Resources team of the Company for a structured Meetings Held

(i.e. till he attains the retirement age) leadership succession plan. During FY 2022-23, two (2) Meetings of the SRC were held

Severance fees/notice period The Agreement may be terminated earlier, without any cause, by either Party by giving to on the following dates:

the other Party six months’ notice of such termination or the Company paying six months’ Retirement Policy for Directors

remuneration which shall be limited to provision of Salary, Benefits, Perquisites, Allowances and As per the Company’s policy, the Managing and Executive • June 21, 2022 • March 3, 2023

any pro-rated lncentive Remuneration (paid at the discretion of the Board, in lieu of such notice). The necessary quorum was present for both the Meetings

Directors retire at the age of 65 years, Non-Independent

There is no separate provision for payment of severance fees. Non-Executive Directors retire at the age of 70 years and of the Committee.

the retirement age for Independent Directors is 75 years. Composition and Attendance

Non-Executive Directors

No.

No. of

During FY 2022-23, the Company paid sitting fees of ` 30,000 per Meeting to the Non-Executive Directors for attending each 5. Stakeholders Relationship Committee Name of the Member Category Meetings held of Meetings

Meeting of the Board; Audit Committee and Nomination and Remuneration Committee; and ` 20,000 per Meeting for attending The Stakeholders Relationship Committee (‘SRC’) attended

each Meeting of Stakeholders Relationship Committee; Meeting of Independent Directors; Corporate Social Responsibility looks into various aspects of interest of shareholders.

Committee; Safety, Health, Environment and Sustainability Committee and Risk Management Committee. The Members The Committee ensures cordial investor relations and Ms. Vibha Paul Rishi ID 2 2

(Chairperson)

had, at the AGM of the Company held on July 25, 2018 approved the payment of commission to the Non-Executive Directors oversees the mechanism for redressal of investors’

within the ceiling of 1% per annum of the net profits of the Company as computed under the applicable provisions of the Act. grievances. Mr. S. Padmanabhan NED 2 2

The said commission is decided each year by the Board of Directors and distributed amongst the Non-Executive Directors based Mr. R. Mukundan MD & CEO 2 2

on their attendance and contribution at the Board and Committee Meetings. The Company also reimburses out-of-pocket Terms of Reference Mr. Zarir Langrana ED 2 2

expenses incurred by the Directors for attending the Meetings.

The terms of reference of the SRC, inter alia, are as under: ID - Independent Director; NED - Non-Executive Director; MD & CEO -

Managing Director & Chief Executive Officer; ED - Executive Director

Details of sitting fees paid and commission payable to the Non-Executive Directors for FY ended March 31, 2023 is • Resolving the grievances of the security holders;

given below:

• Reviewing details of transfer of unclaimed Status of Investor Complaints

(`) dividend/securities to the Investor Education and The status of investor complaints as on March 31, 2023

Name of the Director Sitting Fees paid Commission (for FY 2022-23 Protection Fund; as reported under Regulation 13(3) of the SEBI Listing

during FY 2022-23 payable in FY 2023-24) Regulations is as under:

• Reviewing the transfer, transmission, dematerialisation

Mr. N. Chandrasekaran 1,80,000 @ of securities;

Ms. Vibha Paul Rishi 6,00,000 60,00,000 Pending as on April 1, 2022 0

Mr. S. Padmanabhan 8,10,000 * • Reviewing measures taken for effective exercise of Received during the year 80

Ms. Padmini Khare Kaicker 5,00,000 60,00,000 voting rights by shareholders; Resolved during the year 79

Dr. C. V. Natraj 4,40,000 60,00,000 • Reviewing adherence to the service standards in Pending as on March 31, 2023 1

Mr. K. B. S. Anand 5,50,000 50,00,000 respect of various services being rendered by the

Mr. Rajiv Dube 2,60,000 50,00,000 Registrar & Share Transfer Agent; The complaints have been resolved to the satisfaction

Total 33,40,000 2,80,00,000 of the shareholders. The correspondence identified

• Reviewing various measures and initiatives taken for as investor complaints are letters received through

@ As a policy, Mr. N. Chandrasekaran has abstained from receiving commission from the Company

reducing the quantum of unclaimed dividends; and statutory/regulatory bodies.

*In line with the internal guidelines of the Company, no payment is made towards commission to Mr. S. Padmanabhan, Non-Executive Director of the

Company, who is in full-time employment with other Tata company

172 173