Page 158 - Tata Chemical Annual Report_2022-2023

P. 158

Integrated Annual Report 2022-23 01-83 84-192 193-365

Integrated Report Statutory Reports Financial Statements

Management Discussion

& Analysis

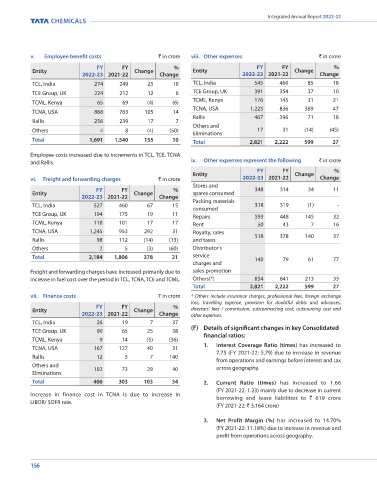

v. Employee benefit costs ` in crore viii. Other expenses ` in crore 4. Return on Net Worth (%) has increased to 12.23% 9. Digitalisation and Information Technology

(FY 2021-22: 8.19%) due to increase in revenue and

FY FY % FY FY % The Company is currently undertaking a project to

Entity Change Entity Change profit from operations across geography.

2022-23 2021-22 Change 2022-23 2021-22 Change modernise its Enterprise Resource Planning (ERP) system,

TCL, India 274 249 25 10 TCL, India 545 460 85 18 (G) Total Debt and Amortisation Schedule with a focus on Business Process Re-engineering (BPR).

TCE Group, UK 224 212 12 6 TCE Group, UK 391 354 37 10 Repayment schedule of existing debt ` in crore The Company aims to migrate from SAP ECC6 to S/4HANA

to streamline processes across all geographies, establish

TCML, Kenya 65 69 (4) (6) TCML, Kenya 176 145 31 21 best practices, and improve operational efficiency. TCL's

TCNA, USA 1,225 836 389 47 8,000 TCL consolidated

TCNA, USA 868 763 105 14 Industry 4.0 agenda includes enhancing its Industrial IIoT

Rallis 467 396 71 18 7,000 6,296

Rallis 256 239 17 7 6,000 applications, with a particular focus on areas such as the

Others and Carbonation Towers located in its Mithapur plant, India.

Others 4 8 (4) (50) 17 31 (14) (45) 5,000

Eliminations 4,000 Additionally, TCL is developing and testing IIoT applications

Total 1,691 1,540 155 10 Total 2,821 2,222 599 27 3,000 for its MUW plant for salt, with the goal of increasing

2,000 2,750 efficiency and improving yield.

Employee costs increased due to increments in TCL, TCE, TCNA 1,000 619 1,039 1,181 707

and Rallis. ix. Other expenses represent the following ` in crore To address the issue of unplanned downtime for critical

FY FY % March 2023 FY 2023-24 FY 2024-25 FY 2025-26 FY 2026-27 FY 2027-28 equipment, TCL is developing a predictive analytics

Entity Change

vi. Freight and forwarding charges ` in crore 2022-23 2021-22 Change Gross Debt Repayment application that predicts Induced Draught (ID) fans and

Stores and CO pumps. The Company has also introduced a video

FY FY % 348 314 34 11 2

Entity Change spares consumed Notes: analytics solution to improve bag counting accuracy and

2022-23 2021-22 Change

TCL, India 527 460 67 15 Packing materials 318 319 (1) - 1. Gross debt of ` 6,296 crore includes ` 325 crore of working capital remotely monitor solar salt pan intake pump operations.

loans/short-term borrowings.

consumed

TCL has also introduced e-logbooks to digitalise its data

TCE Group, UK 194 175 19 11 Repairs 593 448 145 32 2. The repayment schedule for term loans has been prepared capture system. In addition to the above, the Company

TCML, Kenya 118 101 17 17 Rent 50 43 7 16 considering the existing repayment terms. Some of these loans/ plans to implement a spends analytics solution to improve

TCNA, USA 1,245 953 292 31 Royalty, rates facilities may be refinanced / pre-paid, in full or in part, from time to visibility, mitigate risks, analyse historical data, and identify

time in future depending on the requirement and the business plans.

Rallis 98 112 (14) (13) and taxes 518 378 140 37 Non-current portion of finance leases has been included in FY 2024- savings opportunities.

Others 2 5 (3) (60) Distributor's 25 repayment.

Total 2,184 1,806 378 21 service 140 79 61 77 8. Innovation and Technology TCL's IT and digital transformation strategy is regularly

charges and reviewed and revised to align with industry trends and

Freight and forwarding charges have increased primarily due to sales promotion Innovation Centre business requirements, with digital initiatives being adopted

increase in fuel cost over the period in TCL, TCNA, TCE and TCML. Others(*) 854 641 213 33 The Innovation Centre (‘IC’) at Pune is the Company’s across all functions. TCL has implemented a Transportation

Total 2,821 2,222 599 27 science and technology hub for seeding new businesses Management System (TMS) for Tata Chemicals and Rallis

vii. Finance costs ` in crore * Others include insurance charges, professional fees, foreign exchange and accelerating the Company’s sustainable long-term to improve collaboration with transporters and logistics

management. Additionally, the Company has implemented

loss, travelling expense, provision for doubtful debts and advances, growth. IC supports the Company’s businesses by providing

FY FY % Robotic Process Automation (RPA) for selected finance

Entity Change directors’ fees / commission, subcontracting cost, outsourcing cost and cutting-edge technology solutions, and a customer-

2022-23 2021-22 Change other expenses. centric, multi-disciplinary problem-solving approach for processes to enhance productivity. To ensure compliance

TCL, India 26 19 7 37 sustainable growth and differentiation. The Company with labour regulations, TCL has implemented a contractor

TCE Group, UK 90 65 25 38 (F) Details of significant changes in key Consolidated has filed 199 patent applications (cumulative) with 133 management system. The Company also plans to introduce

TCML, Kenya 9 14 (5) (36) financial ratios: patent grants. digital dashboards for all Key Performance Indicators (KPIs)

TCNA, USA 167 127 40 31 1. Interest Coverage Ratio (times) has increased to to democratise the usage of data and analytics.

Rallis 12 5 7 140 7.75 (FY 2021-22: 5.79) due to increase in revenue During the year, IC made significant contributions to the TCL recognises the importance of cybersecurity in

from operations and earnings before interest and tax

Others and 102 73 29 40 across geography. development of green highly dispersible silica (HDS), safeguarding its operations as it journeys towards

Eliminations functional silica and environment-friendly process for digitisation. To enhance manageability, scalability, and

Total 406 303 103 34 2. Current Ratio (times) has increased to 1.66 bio-based surfactants, increased yield of bioactives in agility, TCL is upgrading its on-premises IT infrastructure

medicinal plants through Aeroponics. IC also developed

(FY 2021-22: 1.23) mainly due to decrease in current and adopting cloud technology. Moreover, the Company

Increase in finance cost in TCNA is due to increase in borrowing and lease liabilities to ` 619 crore new FOS variants and co-created innovative applications has upgraded its email, office applications and collaboration

LIBOR/ SOFR rate. of FOS with customers. The Company won the prestigious systems to a more advanced platform that provides better

(FY 2021-22: ` 3,164 crore) CII’s India’s top 50 Innovative Company Award and Top user experience and enhanced cybersecurity.

Innovative Company (Large) in Manufacturing (category

3. Net Profit Margin (%) has increased to 14.70% winner). The Company received special appreciation award TCL's subsidiary, Rallis, continues to embrace digital and

(FY 2021-22: 11.18%) due to increase in revenue and for its Intellectual Property (‘IP’) practices and portfolio analytics solutions to enable agility and excellence in

profit from operations across geography. from CII as well. business operations. For instance, Rallis is implementing

156 157