Page 157 - Tata Chemical Annual Report_2022-2023

P. 157

Integrated Annual Report 2022-23 01-83 84-192 193-365

Integrated Report Statutory Reports Financial Statements

Management Discussion

& Analysis

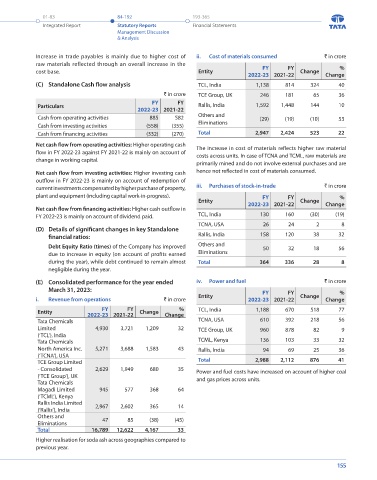

(B) Standalone Balance Sheet Analysis Increase in trade payables is mainly due to higher cost of ii. Cost of materials consumed ` in crore

1. Investments: raw materials reflected through an overall increase in the FY FY %

` in crore cost base. Entity 2022-23 2021-22 Change Change

FY FY % (C) Standalone Cash flow analysis TCL, India 1,138 814 324 40

Particulars Change

2022-23 2021-22 Change

` in crore TCE Group, UK 246 181 65 36

Investments in equity instruments in subsidiaries 3,607 3,607 - - FY FY

Investment in joint venture 336 336 - - Particulars 2022-23 2021-22 Rallis, India 1,592 1,448 144 10

Investment in preference shares in subsidiaries 750 750 - - Cash from operating activities 885 582 Others and (29) (19) (10) 53

Investment in other companies* 4,889 4,971 (82) (2) Cash from investing activities (558) (355) Eliminations

Investments in non-convertible debentures 39 150 (111) (100) Cash from financing activities (332) (270) Total 2,947 2,424 523 22

Investment in mutual funds 1,010 1,113 (103) (9) Net cash flow from operating activities: Higher operating cash

Investment in perpetual instruments 150 - 150 100 flow in FY 2022-23 against FY 2021-22 is mainly on account of The increase in cost of materials reflects higher raw material

costs across units. In case of TCNA and TCML, raw materials are

Total Investment 10,781 10,927 (146) (1) change in working capital. primarily mined and do not involve external purchases and are

* Decrease in the value of investments in other companies is mainly due to changes in fair value of investments. Net cash flow from investing activities: Higher investing cash hence not reflected in cost of materials consumed.

outflow in FY 2022-23 is mainly on account of redemption of

2. Inventories: ` in crore 5. Cash & Cash Equivalent (net) ` in crore current investments compensated by higher purchase of property, iii. Purchases of stock-in-trade ` in crore

FY FY % FY FY % plant and equipment (including capital work-in-progress). Entity FY FY Change %

Particulars Change Particulars Change 2022-23 2021-22 Change

2022-23 2021-22 Change 2022-23 2021-22 Change Net cash flow from financing activities: Higher cash outflow in

Inventories 1,203 880 323 37 Cash and cash FY 2022-23 is mainly on account of dividend paid. TCL, India 130 160 (30) (19)

equivalent

Inventories are higher primarily due to higher prices on inventory (including Bank 85 493 (408) (83) (D) Details of significant changes in key Standalone TCNA, USA 26 24 2 8

of raw materials and coal. balances) financial ratios: Rallis, India 158 120 38 32

Borrowings Others and

3. Trade Receivables: ` in crore Current - Debt Equity Ratio (times) of the Company has improved 50 32 18 56

FY FY % - (3) 3 (100) due to increase in equity (on account of profits earned Eliminations

Particulars Change lease liabilities

2022-23 2021-22 Change Total Borrowings - (3) 3 (100) during the year), while debt continued to remain almost Total 364 336 28 8

Trade receivables 201 182 19 10 Cash and Cash negligible during the year.

equivalent (net) 85 490 (405) (83) iv. Power and fuel ` in crore

Trade receivables are higher primarily due to the higher sales (E) Consolidated performance for the year ended

during the year. Lower cash and cash equivalents have been represented through March 31, 2023: FY FY %

higher outflow in corporate deposits. i. Revenue from operations ` in crore Entity 2022-23 2021-22 Change Change

4. Loans, other financial assets, advance tax assets (net) FY FY % TCL, India 1,188 670 518 77

and other assets: 6. Trade payables, other financial liabilities, other liabilities, Entity 2022-23 2021-22 Change Change

` in crore provisions, current tax liabilities (net) and deferred tax Tata Chemicals TCNA, USA 610 392 218 56

FY FY % liabilities (net) Limited 4,930 3,721 1,209 32 TCE Group, UK 960 878 82 9

Particulars Change ` in crore (‘TCL’), India

2022-23 2021-22 Change TCML, Kenya 136 103 33 32

Loans* 325 - 325 100 Particulars FY FY Change % Tata Chemicals

Other financial 26 64 (38) (59) 2022-23 2021-22 Change North America Inc. 5,271 3,688 1,583 43 Rallis, India 94 69 25 36

(‘TCNA’), USA

assets Trade payables 698 560 138 25 TCE Group Limited Total 2,988 2,112 876 41

Advance tax assets 667 613 54 9 Other 256 181 75 41 - Consolidated 2,629 1,949 680 35 Power and fuel costs have increased on account of higher coal

(net) financial liabilities (‘TCE Group’), UK and gas prices across units.

Other assets 295 278 17 (6) Other liabilities 89 75 14 19 Tata Chemicals

Total 1,313 955 358 37 Provisions 372 352 20 6 Magadi Limited 945 577 368 64

Current tax (‘TCML’), Kenya

*inter-corporate deposits made during the year 91 107 (16) (15) Rallis India Limited

liabilities (tax) 2,967 2,602 365 14

Decrease in other financial assets is mainly due to reduction Deferred tax (‘Rallis’), India

in subsidy receivables. Decrease in other assets is mainly liabilities (net) 390 397 (7) (2) Others and 47 85 (38) (45)

due to settlement of advances given and reduction in Total 1,896 1,672 224 13 Eliminations

statutory receivables. Total 16,789 12,622 4,167 33

Higher realisation for soda ash across geographies compared to

previous year.

154 155