Page 306 - Tata_Chemicals_yearly-reports-2021-22

P. 306

Integrated Annual Report 2021-22

(vi) Debt owed by Valley Holdings Inc. (‘VHI’):

The Bridge loan of ` Nil (USD Nil)(2021: ` 731.10 crore(USD 100 Million)) is unsecured and is repayable in full on December 19,

2022 and the same has been disclosed within the heading current maturity of non-current borrowings. The applicable margin

on the Bridge loan is 3.35% per annum on LIBOR borrowings.

(d) Debt owed by Rallis:

Term loan from Council of Scientific and Industrial Research: The balance payable as on March 31, 2022 is ` Nil (2021: ` 0.08 crore), out

of which ` Nil (2021: ` 0.08 crore) has been disclosed within the heading current maturity of of non-current borrowings. The same is

repayable alongwith interest in 7 annual installments. The loan bears interest of 2% per annum.

(e) Debt owed by Rallis:

Sales Tax Deferral Scheme: The loan is repayable in annual installments which range from a maximum of ` 1.13 crore to a minimum of

` 0.24 crore over the period stretching from April 1, 2022 to March 31, 2027. The amount outstanding is free of interest. The balance

outstanding as at March 31, 2022 is ` 4.68 crore (2021: ` 5.31 crore), out of which ` 0.89 crore (2021: ` 0.63 crore) has been disclosed

within the heading current maturity of non-current borrowings.

(f) Debt owed by Rallis:

Bank overdrafts and cash/packing credit facility ` 0.17 (2021: ` 0.05 crore) are secured by first pari passu charge on inventories

(including raw material, finished goods and work-in-progress) and book debts. The weighted average effective interest rate on the

bank loans is 4.15% per annum (for March 31, 2021 7.12 % per annum).

(g) (i) Debt owed by TCML:

Outstanding loan of ` 3.79 crore (2021: ` 14.21 crore)(2022: USD 0.50 million and 2021: USD 1.94 million). It is a secured

overdraft facility against dues receivable from Kenyan Revenue Authority. The rate of interest for this borrowing is 7.00% per

annum.

(ii) Debt owed by Rallis:

Loan of ` 50.00 crore (2021: ` 30.00 crore) is secured by first pari passu charge on stock (including raw material, finished goods

and work-in-progress) and book debts and carries a weighted average interest of 3.99 % per annum to 4.02% per annum(2021:

7.12% per annum).

(h) Debt owed by TCIPL:

` 181.90 crore (2021: ` 204.71 crore)(2022: USD 24 million and 2021: USD 28 million) is towards unsecured working capital facility and

is repayable within 90 days (2021: 90 days) . Interest is charged at 0.67% to 1.21% (2021: 0.80% to 2.62%) per annum.

(i) Suppliers’ credit:

Unsecured Supplier’s credit repayable on demand bears interest ranging from 1.05 % to 1.17 % per annum (2021: 1.13 % to 2.49 %

per annum).

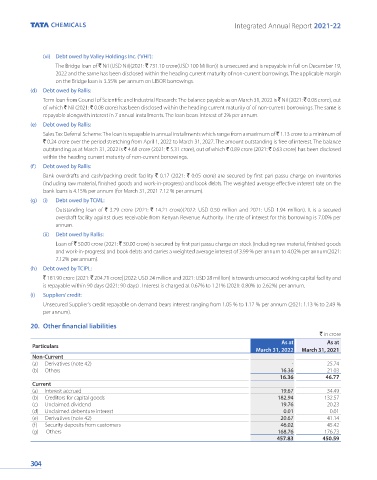

20. Other financial liabilities

` in crore

As at As at

Particulars

March 31, 2022 March 31, 2021

Non-Current

(a) Derivatives (note 42) - 25.74

(b) Others 16.36 21.03

16.36 46.77

Current

(a) Interest accrued 19.67 34.49

(b) Creditors for capital goods 182.94 132.57

(c) Unclaimed dividend 19.76 20.23

(d) Unclaimed debenture interest 0.01 0.01

(e) Derivatives (note 42) 20.67 41.14

(f) Security deposits from customers 46.02 45.42

(g) Others 168.76 176.73

457.83 450.59

304