Page 308 - Tata_Chemicals_yearly-reports-2021-22

P. 308

Integrated Annual Report 2021-22

Nature of provisions:

(1) Provision for asset retirement obligation represents site restoration expense and decommissioning charges in India and cost towards

reclamation of the mine and land upon the termination of the partnership in USA. The timing of the outflows is expected to be within

a period of 1 to 96 years from the date of Consolidated Balance Sheet.

(2) Provision for emission allowance represents obligations to surrender carbon emission allowances under the UK/EU emissions trading

scheme. The timing of the outflows is expected to be within a period of one year from the date of Consolidated Balance Sheet.

(3) Provision for warranty relates to certain products that fail to perform satisfactorily during the warranty period. Provision made as

at respective year end represents the amount of the expected cost of meeting such obligations of rectification/replacement. The

timing of the outflows is expected to be within a period of one year from the date of Consolidated Balance Sheet.

(4) Provision for litigations and others represents management’s best estimate of outflow of economic resources in respect of water

charges, entry tax, land revenue and other disputed items including direct taxes, indirect taxes and other claims. The timing of

outflows is uncertain and will depend on the cessation of the respective cases.

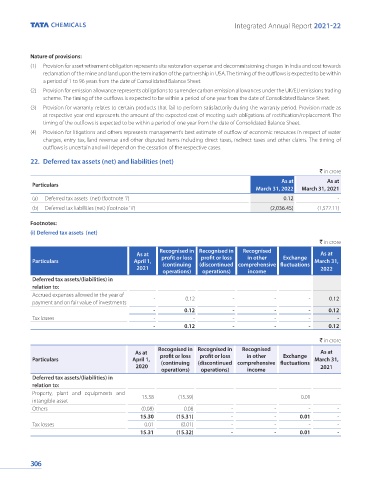

22. Deferred tax assets (net) and liabilities (net)

` in crore

As at As at

Particulars

March 31, 2022 March 31, 2021

(a) Deferred tax assets (net) (footnote 'i') 0.12 -

(b) Deferred tax liabilities (net) (footnote 'ii') (2,036.45) (1,572.11)

Footnotes:

(i) Deferred tax assets (net)

` in crore

Recognised in Recognised in Recognised

As at As at

Particulars April 1, profit or loss profit or loss in other Exchange March 31,

2021 (continuing (discontinued comprehensive fluctuations 2022

operations) operations) income

Deferred tax assets/(liabilities) in

relation to:

Accrued expenses allowed in the year of - 0.12 - - - 0.12

payment and on fair value of investments

- 0.12 - - - 0.12

Tax losses - - - - - -

- 0.12 - - - 0.12

` in crore

Recognised in Recognised in Recognised

As at As at

Particulars April 1, profit or loss profit or loss in other Exchange March 31,

2020 (continuing (discontinued comprehensive fluctuations 2021

operations) operations) income

Deferred tax assets/(liabilities) in

relation to:

Property, plant and equipments and 15.38 (15.39) - - 0.01 -

intangible asset

Others (0.08) 0.08 - - - -

15.30 (15.31) - - 0.01 -

Tax losses 0.01 (0.01) - - - -

15.31 (15.32) - - 0.01 -

306