Page 304 - Tata_Chemicals_yearly-reports-2021-22

P. 304

Integrated Annual Report 2021-22

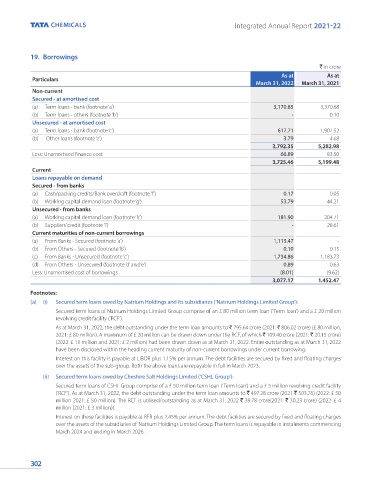

19. Borrowings

` in crore

As at As at

Particulars

March 31, 2022 March 31, 2021

Non-current

Secured - at amortised cost

(a) Term loans - bank (footnote ‘a’) 3,170.85 3,370.68

(b) Term loans - others (footnote ‘b’) - 0.10

Unsecured - at amortised cost

(a) Term loans - bank (footnote ‘c’) 617.71 1,907.52

(b) Other loans (footnote ‘e’) 3.79 4.68

3,792.35 5,282.98

Less: Unamortised finance cost 66.89 83.50

3,725.46 5,199.48

Current

Loans repayable on demand

Secured - from banks

(a) Cash/packing credits/Bank overdraft (footnote ‘f’) 0.17 0.05

(b) Working capital demand loan (footnote ‘g’) 53.79 44.21

Unsecured - from banks

(a) Working capital demand loan (footnote ‘h’) 181.90 204.71

(b) Suppliers’ credit (footnote ‘i’) - 28.61

Current maturities of non-current borrowings

(a) From Banks - Secured (footnote ‘a’) 1,113.47 -

(b) From Others - Secured (footnote ‘b’) 0.10 0.15

(c) From Banks - Unsecured (footnote ‘c’) 1,734.86 1,183.73

(d) From Others - Unsecured (footnote ‘d’ and ‘e’) 0.89 0.63

Less: Unamortised cost of borrowings (8.01) (9.62)

3,077.17 1,452.47

Footnotes:

(a) (i) Secured term loans owed by Natrium Holdings and its subsidiaries (‘Natrium Holdings Limited Group’):

Secured term loans of Natrium Holdings Limited Group comprise of an £ 80 million term loan (‘Term loan’) and a £ 20 million

revolving credit facility (‘RCF’).

As at March 31, 2022, the debt outstanding under the term loan amounts to ` 795.64 crore (2021: ` 806.02 crore) (£ 80 million,

2021: £ 80 million). A maximum of £ 20 million can be drawn down under the RCF, of which ` 109.40 crore (2021: ` 20.15 crore)

(2022: £ 11 million and 2021: £ 2 million) had been drawn down as at March 31, 2022. Entire outstanding as at March 31, 2022

have been disclosed within the heading current maturity of non-current borrowings under current borrowing.

Interest on this facility is payable at LIBOR plus 1.15% per annum. The debt facilities are secured by fixed and floating charges

over the assets of the sub-group. Both the above loans are repayable in full in March 2023.

(ii) Secured term loans owed by Cheshire Salt Holdings Limited (‘CSHL Group’):

Secured term loans of CSHL Group comprise of a £ 50 million term loan (‘Term loan’) and a £ 5 million revolving credit facility

(‘RCF’). As at March 31, 2022, the debt outstanding under the term loan amounts to ` 497.28 crore (2021 ` 503.76) (2022: £ 50

million 2021: £ 50 million). The RCF is utilised/outstanding as at March 31, 2022 ` 39.78 crore(2021: ` 30.23 crore) (2022: £ 4

million (2021: £ 3 million)).

Interest on these facilities is payable at RFR plus 2.45% per annum. The debt facilities are secured by fixed and floating charges

over the assets of the subsidiaries of ‘Natrium Holdings Limited Group. The term loans is repayable in instalments commencing

March 2024 and ending in March 2026.

302