Page 301 - Tata_Chemicals_yearly-reports-2021-22

P. 301

01 INTEGRATED 73 STATUTORY 178 FINANCIAL

STATEMENTS

REPORT

REPORTS

Consolidated

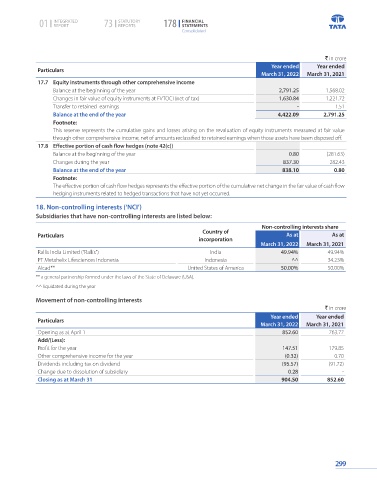

` in crore

Year ended Year ended

Particulars

March 31, 2022 March 31, 2021

17.7 Equity instruments through other comprehensive income

Balance at the beginning of the year 2,791.25 1,568.02

Changes in fair value of equity instruments at FVTOCI (net of tax) 1,630.84 1,221.72

Transfer to retained earnings - 1.51

Balance at the end of the year 4,422.09 2,791.25

Footnote:

This reserve represents the cumulative gains and losses arising on the revaluation of equity instruments measured at fair value

through other comprehensive income, net of amounts reclassified to retained earnings when those assets have been disposed off.

17.8 Effective portion of cash flow hedges (note 42(c))

Balance at the beginning of the year 0.80 (281.63)

Changes during the year 837.30 282.43

Balance at the end of the year 838.10 0.80

Footnote:

The effective portion of cash flow hedges represents the effective portion of the cumulative net change in the fair value of cash flow

hedging instruments related to hedged transactions that have not yet occurred.

18. Non-controlling interests (‘NCI’)

Subsidiaries that have non-controlling interests are listed below:

Non-controlling interests share

Country of

Particulars As at As at

incorporation

March 31, 2022 March 31, 2021

Rallis India Limited (“Rallis”) India 49.94% 49.94%

PT Metahelix Lifesciences Indonesia Indonesia ^^ 34.23%

Alcad** United States of America 50.00% 50.00%

** a general partnership formed under the laws of the State of Delaware (USA).

^^ liquidated during the year

Movement of non-controlling interests

` in crore

Year ended Year ended

Particulars

March 31, 2022 March 31, 2021

Opening as at April 1 852.60 763.77

Add/(Less):

Profit for the year 147.51 179.85

Other comprehensive income for the year (0.32) 0.70

Dividends including tax on dividend (95.57) (91.72)

Change due to dissolution of subsidiary 0.28 -

Closing as at March 31 904.50 852.60

299