Page 311 - Tata_Chemicals_yearly-reports-2021-22

P. 311

01 INTEGRATED 73 STATUTORY 178 FINANCIAL

STATEMENTS

REPORT

REPORTS

Consolidated

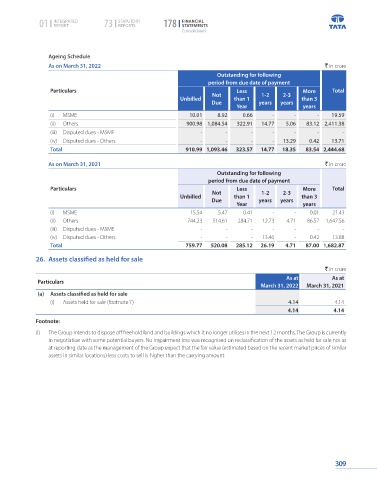

Ageing Schedule

As on March 31, 2022 ` in crore

Outstanding for following

period from due date of payment

Particulars Less More Total

Unbilled Not than 1 1-2 2-3 than 3

Due years years

Year years

(i) MSME 10.01 8.92 0.66 - - - 19.59

(ii) Others 900.98 1,084.54 322.91 14.77 5.06 83.12 2,411.38

(iii) Disputed dues - MSME - - - - - - -

(iv) Disputed dues - Others - - - - 13.29 0.42 13.71

Total 910.99 1,093.46 323.57 14.77 18.35 83.54 2,444.68

As on March 31, 2021 ` in crore

Outstanding for following

period from due date of payment

Particulars Less More Total

Unbilled Not than 1 1-2 2-3 than 3

Due years years

Year years

(i) MSME 15.54 5.47 0.41 - - 0.01 21.43

(ii) Others 744.23 514.61 284.71 12.73 4.71 86.57 1,647.56

(iii) Disputed dues - MSME - - - - - - -

(iv) Disputed dues - Others - - - 13.46 - 0.42 13.88

Total 759.77 520.08 285.12 26.19 4.71 87.00 1,682.87

26. Assets classified as held for sale

` in crore

As at As at

Particulars

March 31, 2022 March 31, 2021

(a) Assets classified as held for sale

(i) Assets held for sale (footnote ‘i’) 4.14 4.14

4.14 4.14

Footnote:

(i) The Group intends to dispose off freehold land and buildings which it no longer utilises in the next 12 months. The Group is currently

in negotiation with some potential buyers. No impairment loss was recognised on reclassification of the assets as held for sale nor as

at reporting date as the management of the Group expect that the fair value (estimated based on the recent market prices of similar

assets in similar locations) less costs to sell is higher than the carrying amount.

309