Page 302 - Tata_Chemicals_yearly-reports-2021-22

P. 302

Integrated Annual Report 2021-22

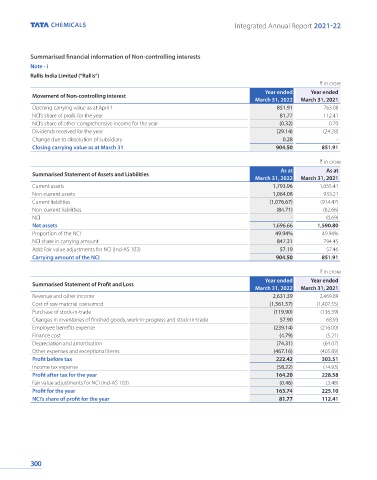

Summarised financial information of Non-controlling interests

Note - i

Rallis India Limited (“Rallis”)

₹ in crore

Year ended Year ended

Movement of Non-controlling interest

March 31, 2022 March 31, 2021

Opening carrying value as at April 1 851.91 763.08

NCI’s share of profit for the year 81.77 112.41

NCI’s share of other comprehensive income for the year (0.32) 0.70

Dividends received for the year (29.14) (24.28)

Change due to dissolution of subsidiary 0.28 -

Closing carrying value as at March 31 904.50 851.91

₹ in crore

As at As at

Summarised Statement of Assets and Liabilities

March 31, 2022 March 31, 2021

Current assets 1,793.96 1,655.41

Non-current assets 1,064.08 933.21

Current liabilities (1,076.67) (914.47)

Non-current liabilities (84.71) (82.66)

NCI - (0.69)

Net assets 1,696.66 1,590.80

Proportion of the NCI 49.94% 49.94%

NCI share in carrying amount 847.31 794.45

Add: Fair value adjustments for NCI (Ind-AS 103) 57.19 57.46

Carrying amount of the NCI 904.50 851.91

₹ in crore

Year ended Year ended

Summarised Statement of Profit and Loss

March 31, 2022 March 31, 2021

Revenue and other income 2,631.39 2,469.89

Cost of raw material consumed (1,561.57) (1,407.55)

Purchase of stock-in-trade (119.90) (136.59)

Changes in inventories of finished goods, work-in-progress and stock-in-trade 57.90 68.93

Employee benefits expense (239.14) (216.00)

Finance cost (4.79) (5.21)

Depreciation and amortisation (74.31) (64.07)

Other expenses and exceptional items (467.16) (405.89)

Profit before tax 222.42 303.51

Income tax expense (58.22) (74.93)

Profit after tax for the year 164.20 228.58

Fair value adjustments for NCI (Ind-AS 103) (0.46) (3.48)

Profit for the year 163.74 225.10

NCI’s share of profit for the year 81.77 112.41

300