Page 300 - Tata_Chemicals_yearly-reports-2021-22

P. 300

Integrated Annual Report 2021-22

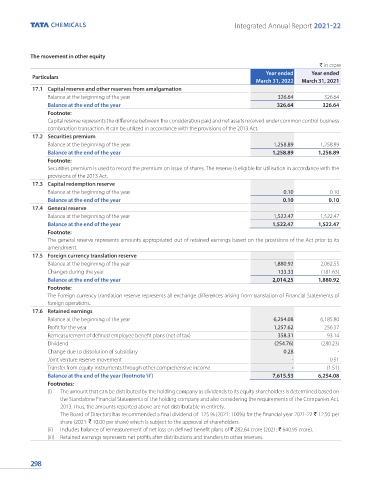

The movement in other equity

` in crore

Year ended Year ended

Particulars

March 31, 2022 March 31, 2021

17.1 Capital reserve and other reserves from amalgamation

Balance at the beginning of the year 326.64 326.64

Balance at the end of the year 326.64 326.64

Footnote:

Capital reserve represents the difference between the consideration paid and net assets received under common control business

combination transaction. It can be utilized in accordance with the provisions of the 2013 Act.

17.2 Securities premium

Balance at the beginning of the year 1,258.89 1,258.89

Balance at the end of the year 1,258.89 1,258.89

Footnote:

Securities premium is used to record the premium on issue of shares. The reserve is eligible for utilisation in accordance with the

provisions of the 2013 Act.

17.3 Capital redemption reserve

Balance at the beginning of the year 0.10 0.10

Balance at the end of the year 0.10 0.10

17.4 General reserve

Balance at the beginning of the year 1,522.47 1,522.47

Balance at the end of the year 1,522.47 1,522.47

Footnote:

The general reserve represents amounts appropriated out of retained earnings based on the provisions of the Act prior to its

amendment.

17.5 Foreign currency translation reserve

Balance at the beginning of the year 1,880.92 2,062.55

Changes during the year 133.33 (181.63)

Balance at the end of the year 2,014.25 1,880.92

Footnote:

The Foreign currency translation reserve represents all exchange differences arising from translation of Financial Statements of

foreign operations.

17.6 Retained earnings

Balance at the beginning of the year 6,254.08 6,185.80

Profit for the year 1,257.62 256.37

Remeasurement of defined employee benefit plans (net of tax) 358.31 93.14

Dividend (254.76) (280.23)

Change due to dissolution of subsidiary 0.28 -

Joint venture reserve movement - 0.51

Transfer from equity instruments through other comprehensive income - (1.51)

Balance at the end of the year (footnote ‘ii’) 7,615.53 6,254.08

Footnotes:

(i) The amount that can be distributed by the holding company as dividends to its equity shareholders is determined based on

the Standalone Financial Statements of the holding company and also considering the requirements of the Companies Act,

2013. Thus, the amounts reported above are not distributable in entirety.

The Board of Directors has recommended a final dividend of 125 % (2021: 100%) for the financial year 2021-22 ` 12.50 per

share (2021: ` 10.00 per share) which is subject to the approval of shareholders.

(ii) Includes balance of remeasurement of net loss on defined benefit plans of ` 282.64 crore (2021: ` 640.95 crore).

(iii) Retained earnings represents net profits after distributions and transfers to other reserves.

298