Page 256 - Tata_Chemicals_yearly-reports-2020-2021

P. 256

Integrated Annual Report 2020-21

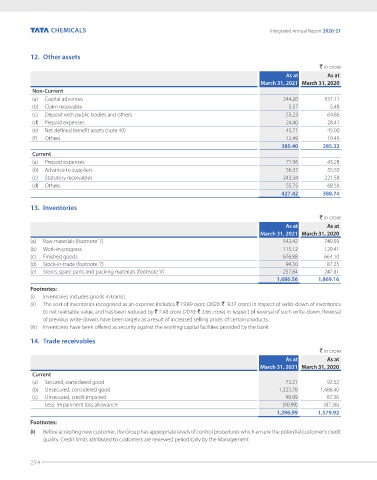

12. Other assets

` in crore

As at As at

March 31, 2021 March 31, 2020

Non-Current

(a) Capital advances 244.20 131.11

(b) Claim receivable 5.37 5.48

(c) Deposit with public bodies and others 53.23 64.86

(d) Prepaid expenses 24.40 28.41

(e) Net defined benefit assets (note 40) 45.71 45.00

(f) Others 12.49 10.46

385.40 285.32

Current

(a) Prepaid expenses 71.96 43.28

(b) Advance to suppliers 56.37 55.50

(c) Statutory receivables 243.34 221.58

(d) Others 55.75 68.38

427.42 388.74

13. Inventories

` in crore

As at As at

March 31, 2021 March 31, 2020

(a) Raw materials (footnote 'i') 542.42 740.59

(b) Work-in-progress 115.12 129.41

(c) Finished goods 676.88 664.10

(d) Stock-in-trade (footnote 'i') 94.30 87.25

(e) Stores, spare parts and packing materials (footnote 'i') 257.84 247.81

1,686.56 1,869.16

Footnotes:

(i) Inventories includes goods in transit.

(ii) The cost of inventories recognised as an expense includes ` 19.89 crore (2020: ` 9.37 crore) in respect of write-down of inventories

to net realisable value, and has been reduced by ` 2.48 crore (2020: ` 3.66 crore) in respect of reversal of such write-down. Reversal

of previous write-downs have been largely as a result of increased selling prices of certain products.

(iii) Inventories have been offered as security against the working capital facilities provided by the bank.

14. Trade receivables

` in crore

As at As at

March 31, 2021 March 31, 2020

Current

(a) Secured, considered good 73.21 93.52

(b) Unsecured, considered good 1,323.78 1,486.40

(c) Unsecured, credit impaired 90.99 87.36

Less: Impairment loss allowance (90.99) (87.36)

1,396.99 1,579.92

Footnotes:

(i) Before accepting new customer, the Group has appropriate levels of control procedures which ensure the potential customer's credit

quality. Credit limits attributed to customers are reviewed periodically by the Management.

254