Page 258 - Tata_Chemicals_yearly-reports-2020-2021

P. 258

Integrated Annual Report 2020-21

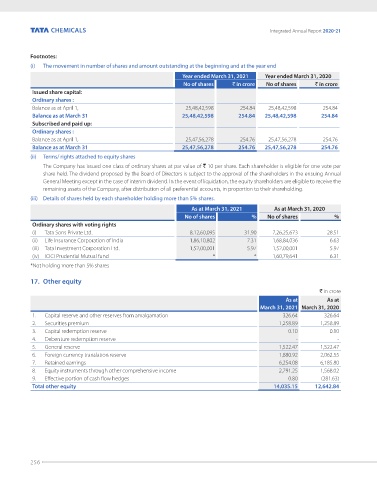

Footnotes:

(i) The movement in number of shares and amount outstanding at the beginning and at the year end

Year ended March 31, 2021 Year ended March 31, 2020

No of shares ` in crore No of shares ` in crore

Issued share capital:

Ordinary shares :

Balance as at April 1, 25,48,42,598 254.84 25,48,42,598 254.84

Balance as at March 31 25,48,42,598 254.84 25,48,42,598 254.84

Subscribed and paid up:

Ordinary shares :

Balance as at April 1, 25,47,56,278 254.76 25,47,56,278 254.76

Balance as at March 31 25,47,56,278 254.76 25,47,56,278 254.76

(ii) Terms/ rights attached to equity shares

The Company has issued one class of ordinary shares at par value of ` 10 per share. Each shareholder is eligible for one vote per

share held. The dividend proposed by the Board of Directors is subject to the approval of the shareholders in the ensuing Annual

General Meeting except in the case of interim dividend. In the event of liquidation, the equity shareholders are eligible to receive the

remaining assets of the Company, after distribution of all preferential accounts, in proportion to their shareholding.

(iii) Details of shares held by each shareholder holding more than 5% shares.

As at March 31, 2021 As at March 31, 2020

No of shares % No of shares %

Ordinary shares with voting rights

(i) Tata Sons Private Ltd. 8,12,60,095 31.90 7,26,25,673 28.51

(ii) Life Insurance Corporation of India 1,86,10,802 7.31 1,68,84,036 6.63

(iii) Tata Investment Corporation Ltd. 1,52,00,001 5.97 1,52,00,001 5.97

(iv) ICICI Prudential Mutual fund * * 1,60,79,641 6.31

*Not holding more than 5% shares

17. Other equity

` in crore

As at As at

March 31, 2021 March 31, 2020

1. Capital reserve and other reserves from amalgamation 326.64 326.64

2. Securities premium 1,258.89 1,258.89

3. Capital redemption reserve 0.10 0.10

4. Debenture redemption reserve - -

5. General reserve 1,522.47 1,522.47

6. Foreign currency translation reserve 1,880.92 2,062.55

7. Retained earnings 6,254.08 6,185.80

8. Equity instruments through other comprehensive income 2,791.25 1,568.02

9. Effective portion of cash flow hedges 0.80 (281.63)

Total other equity 14,035.15 12,642.84

256