Page 252 - Tata_Chemicals_yearly-reports-2020-2021

P. 252

Integrated Annual Report 2020-21

An analysis of the sensitivity of the change in key parameters (operating margin, discount rates and long term average growth rate),

based on reasonably probable assumptions, did not result in any probable scenario in which the recoverable amount of the CGUs would

decrease below the carrying amount.

Goodwill of ` 151.93 crore (2020: ` 151.93 crore) has been allocated to three CGUs (Individually immaterial) within the specialty products,

and evaluated based on their recoverable amounts which exceeds their carrying amounts.

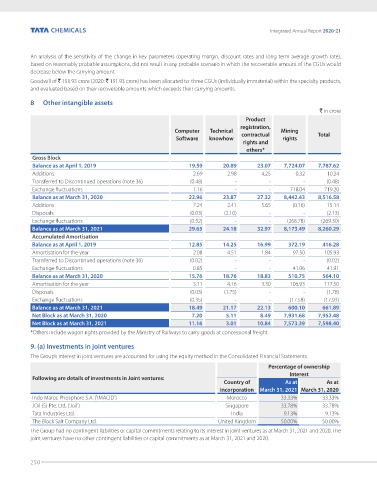

8 Other intangible assets

` in crore

Product

registration,

Computer Technical contractual Mining Total

Software knowhow rights

rights and

others*

Gross Block

Balance as at April 1, 2019 19.59 20.89 23.07 7,724.07 7,787.62

Additions 2.69 2.98 4.25 0.32 10.24

Transferred to Discontinued operations (note 36) (0.48) - - - (0.48)

Exchange fluctuations 1.16 - - 718.04 719.20

Balance as at March 31, 2020 22.96 23.87 27.32 8,442.43 8,516.58

Additions 7.24 2.41 5.65 (0.16) 15.14

Disposals (0.03) (2.10) - - (2.13)

Exchange fluctuations (0.52) - - (268.78) (269.30)

Balance as at March 31, 2021 29.65 24.18 32.97 8,173.49 8,260.29

Accumulated Amortisation

Balance as at April 1, 2019 12.85 14.25 16.99 372.19 416.28

Amortisation for the year 2.08 4.51 1.84 97.50 105.93

Transferred to Discontinued operations (note 36) (0.02) - - - (0.02)

Exchange fluctuations 0.85 - - 41.06 41.91

Balance as at March 31, 2020 15.76 18.76 18.83 510.75 564.10

Amortisation for the year 3.11 4.16 3.30 106.93 117.50

Disposals (0.03) (1.75) - - (1.78)

Exchange fluctuations (0.35) - - (17.58) (17.93)

Balance as at March 31, 2021 18.49 21.17 22.13 600.10 661.89

Net Block as at March 31, 2020 7.20 5.11 8.49 7,931.68 7,952.48

Net Block as at March 31, 2021 11.16 3.01 10.84 7,573.39 7,598.40

*Others include wagon rights provided by the Ministry of Railways to carry goods at concessional freight.

9. (a) Investments in joint ventures

The Group’s interest in joint ventures are accounted for using the equity method in the Consolidated Financial Statements.

Percentage of ownership

Interest

Following are details of investments in Joint ventures:

Country of As at As at

incorporation March 31, 2021 March 31, 2020

Indo Maroc Phosphore S.A. ('IMACID') Morocco 33.33% 33.33%

JOil (S) Pte. Ltd. ('Joil') Singapore 33.78% 33.78%

Tata Industries Ltd. India 9.13% 9.13%

The Block Salt Company Ltd. United Kingdom 50.00% 50.00%

The Group had no contingent liabilities or capital commitments relating to its interest in joint ventures as at March 31, 2021 and 2020. The

joint ventures have no other contingent liabilities or capital commitments as at March 31, 2021 and 2020.

250