Page 260 - Tata_Chemicals_yearly-reports-2020-2021

P. 260

Integrated Annual Report 2020-21

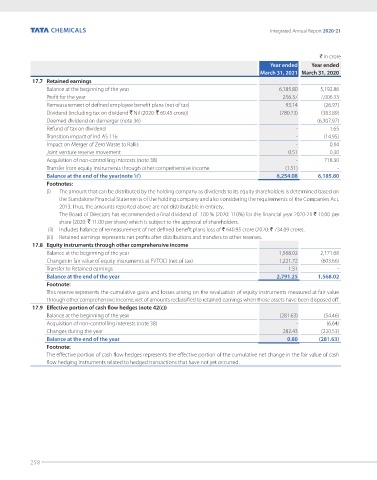

` in crore

Year ended Year ended

March 31, 2021 March 31, 2020

17.7 Retained earnings

Balance at the beginning of the year 6,185.80 5,192.86

Profit for the year 256.37 7,006.33

Remeasurement of defined employee benefit plans (net of tax) 93.14 (26.97)

Dividend (including tax on dividend ` Nil (2020: ` 60.45 crore)) (280.23) (383.89)

Deemed dividend on demerger (note 36) - (6,307.97)

Refund of tax on dividend - 1.65

Transition impact of Ind AS 116 - (14.95)

Impact on Merger of Zero Waste to Rallis - 0.14

Joint venture reserve movement 0.51 0.30

Acquisition of non-controlling interests (note 38) - 718.30

Transfer from equity instruments through other comprehensive income (1.51) -

Balance at the end of the year(note 'ii') 6,254.08 6,185.80

Footnotes:

(i) The amount that can be distributed by the holding company as dividends to its equity shareholders is determined based on

the Standalone Financial Statements of the holding company and also considering the requirements of the Companies Act,

2013. Thus, the amounts reported above are not distributable in entirety.

The Board of Directors has recommended a final dividend of 100 % (2020: 110%) for the financial year 2020-21 ` 10.00 per

share (2020: ` 11.00 per share) which is subject to the approval of shareholders.

(ii) Includes balance of remeasurement of net defined benefit plans loss of ` 640.95 crore (2020: ` 734.09 crore).

(iii) Retained earnings represents net profits after distributions and transfers to other reserves.

17.8 Equity instruments through other comprehensive income

Balance at the beginning of the year 1,568.02 2,171.68

Changes in fair value of equity instruments at FVTOCI (net of tax) 1,221.72 (603.66)

Transfer to Retained earnings 1.51 -

Balance at the end of the year 2,791.25 1,568.02

Footnote:

This reserve represents the cumulative gains and losses arising on the revaluation of equity instruments measured at fair value

through other comprehensive income, net of amounts reclassified to retained earnings when those assets have been disposed off.

17.9 Effective portion of cash flow hedges (note 42(c))

Balance at the beginning of the year (281.63) (54.46)

Acquisition of non-controlling interests (note 38) - (6.64)

Changes during the year 282.43 (220.53)

Balance at the end of the year 0.80 (281.63)

Footnote:

The effective portion of cash flow hedges represents the effective portion of the cumulative net change in the fair value of cash

flow hedging instruments related to hedged transactions that have not yet occurred.

258