Page 129 - Tata_Chemicals_yearly-reports-2020-2021

P. 129

Integrated Report Statutory Reports Financial Statements

1-59 Corporate Governance Report 147-300

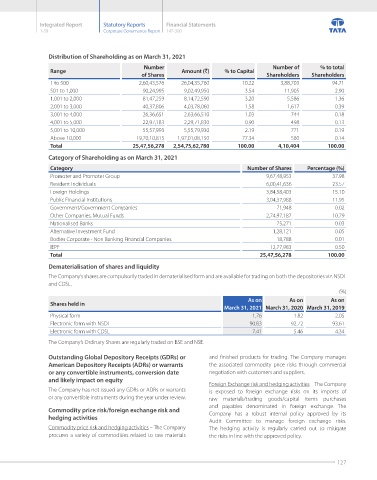

Distribution of Shareholding as on March 31, 2021

Number Number of % to total

Range Amount (`) % to Capital

of Shares Shareholders Shareholders

1 to 500 2,60,43,576 26,04,35,760 10.22 3,88,703 94.71

501 to 1,000 90,24,995 9,02,49,950 3.54 11,905 2.90

1,001 to 2,000 81,47,259 8,14,72,590 3.20 5,586 1.36

2,001 to 3,000 40,37,806 4,03,78,060 1.58 1,617 0.39

3,001 to 4,000 26,36,651 2,63,66,510 1.03 744 0.18

4,001 to 5,000 22,97,183 2,29,71,830 0.90 498 0.13

5,001 to 10,000 55,57,993 5,55,79,930 2.19 771 0.19

Above 10,000 19,70,10,815 1,97,01,08,150 77.34 580 0.14

Total 25,47,56,278 2,54,75,62,780 100.00 4,10,404 100.00

Category of Shareholding as on March 31, 2021

Category Number of Shares Percentage (%)

Promoter and Promoter Group 9,67,48,953 37.98

Resident Individuals 6,00,41,636 23.57

Foreign Holdings 3,84,58,403 15.10

Public Financial Institutions 3,04,37,988 11.95

Government/Government Companies 71,948 0.02

Other Companies, Mutual Funds 2,74,97,187 10.79

Nationalised Banks 75,271 0.03

Alternative Investment Fund 1,28,121 0.05

Bodies Corporate - Non Banking Financial Companies 18,788 0.01

IEPF 12,77,983 0.50

Total 25,47,56,278 100.00

Dematerialisation of shares and liquidity

The Company’s shares are compulsorily traded in dematerialised form and are available for trading on both the depositories viz. NSDL

and CDSL.

(%)

As on As on As on

Shares held in

March 31, 2021 March 31, 2020 March 31, 2019

Physical form 1.76 1.82 2.05

Electronic form with NSDL 90.83 92.72 93.61

Electronic form with CDSL 7.41 5.46 4.34

The Company’s Ordinary Shares are regularly traded on BSE and NSE.

Outstanding Global Depository Receipts (GDRs) or and finished products for trading. The Company manages

American Depository Receipts (ADRs) or warrants the associated commodity price risks through commercial

or any convertible instruments, conversion date negotiation with customers and suppliers.

and likely impact on equity

Foreign Exchange risk and hedging activities – The Company

The Company has not issued any GDRs or ADRs or warrants is exposed to foreign exchange risks on its imports of

or any convertible instruments during the year under review. raw materials/trading goods/capital items purchases

and payables denominated in foreign exchange. The

Commodity price risk/foreign exchange risk and Company has a robust internal policy approved by its

hedging activities

Audit Committee to manage foreign exchange risks.

Commodity price risk and hedging activities – The Company The hedging activity is regularly carried out to mitigate

procures a variety of commodities related to raw materials the risks in line with the approved policy.

127